Sanjeev Sharma

Tribune News Service

New Delhi, September 22

The stock markets suffered the biggest fall in over nine months and the rupee hit a near six-month low in intra-day trade before recovering on concerns that the proposed fiscal stimulus would hurt the fiscal deficit target even as the government tried to quell concerns about government finances and revenue collection under the GST.

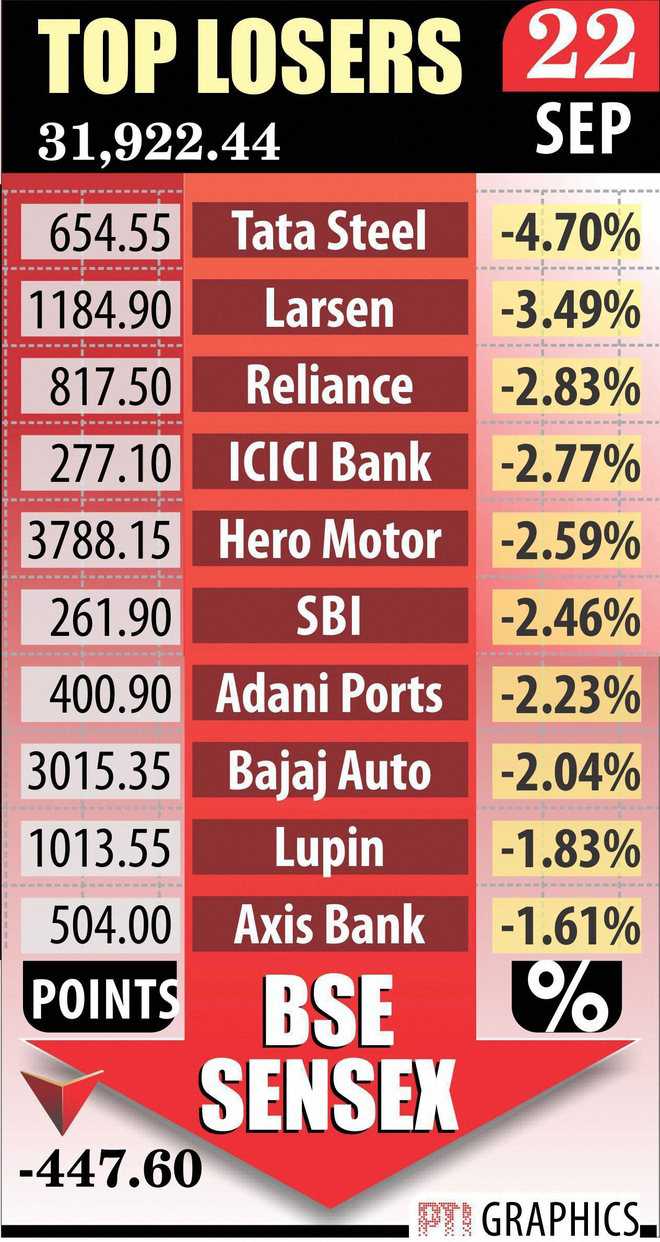

The Sensex tumbled by 447 points — the biggest fall in over nine months over concerns as the rupee plummeted to a intra-day six month low of 65.15 per dollar — its weakest level since April 5, as talk of a stimulus package is seen to be leading to a widening fiscal deficit. However, the rupee showed a strong recovery and ended a marginal two paise higher at 64.79 per dollar.

There are growing calls for a stimulus package with industry body CII today suggesting the need to relax the fiscal deficit targets to accommodate stimulus measures, particularly for job-creating sectors. The FRBM Act permits a deviation of 0.5% of GDP on account of exceptional circumstances.

"The introduction of the historical tax reform of GST calls for certain adjustment time," CII said. The chamber has called for an interest rate cut of 100 basis points and depreciation of the exchange rate that would increase export-related jobs.

DBS Research said along with a firmer global US dollar, domestic headwinds by way of slowing growth, a wider Q2 current account deficit and signs of a wider fiscal deficit, have depressed the rupee and bonds this week. This year's fiscal math is already stressed. April-July deficit ballooned to 92% of the full-year target with eight months of the fiscal year still to go.

The government clarified that an amount of Rs 95,000 crore, which was received in August for GST, was also not incredibly high since Rs 1.27 lakh crore of credit of Central Excise and Service Tax was lying as closing balance as on June 30, 2017 as per department's record.

The Finance Ministry also clarified on the apprehensions about the problem of blockage of working capital for exporters post-GST.

It said as of now, for 66% of the value of exports, exporters have preferred the duty drawback scheme instead of taking actual refund of input taxes in the pre-GST regime.

Financial prudence a challenge

"How do you maintain the balancing act between continuing to spend in an economy, continuing to support your banks and at the same time maintain the best standards of fiscal prudence? I think the last part is the current challenge that we are facing

Plan to consolidate public sector banks on

"The government is more keen to merge stronger banks rather than weaker ones and is in the process of finalising a strategy on consolidation of state-run lenders. The object of consolidation is to create bigger and stronger banks

Economy on track despite headwinds

"Despite unsupportive global factors, the government has broadly put the economy on track. Here we were facing somewhat globally unsupportive environments. And yet, I will say with a sense of satisfaction that we have broadly put the economy on track". — - Arun Jaitley, Finance Minister