Sanjeev Sharma

Tribune News Service

New Delhi, November 16

A day after notifying a sharp reduction in GST rates for items of mass consumption, the Cabinet today approved setting up of a National Anti-profiteering Authority (NAA) to ensure that benefits of such tariff cuts are passed on to consumers.

The anti-profiteering measures prescribed in the GST law provide an institutional mechanism to ensure the full benefits of input tax credits and reduced GST rates on supply of goods or services flow to the consumers. This institutional framework comprises the NAA, a standing committee, screening committees in every state and the Directorate General of Safeguards in the Central Board of Excise & Customs (CBEC).

A five-member committee, headed by Cabinet Secretary PK Sinha, comprising Revenue Secretary Hasmukh Adhia, CBEC Chairman Vanaja Sarna and chief secretaries from two states, has been entrusted to finalise the chairman and members of the authority. The authority will have a sunset date of two years from the date on which the chairman assumes charge. The chairman and the four members of the authority have to be less than 62 years.

“The NAA is an assurance to consumers of India. If any consumer feels that the benefit of tax rate cut is not being passed on, then he can complaint to the authority,” Union Minister Ravi Shankar Prasad said after the Cabinet meeting. This reflects the government’s commitment to take all-possible steps to ensure benefits of implementation of GST to the common man, the minister said.

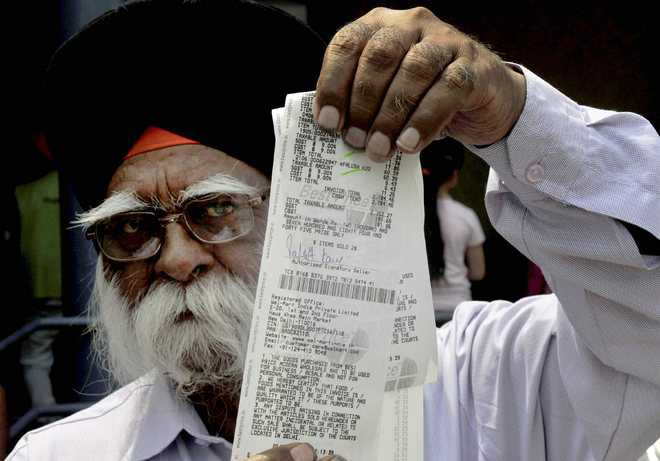

As per the guidelines for consumer appeals, affected consumers who feel the benefit of commensurate reduction in prices is not being passed on when they purchase any goods or services may apply for relief to the screening committee in the particular state. However, in case the incident of profiteering relates to an item of mass impact with ‘all-India’ ramification, the application may be directly made to the standing committee.

After forming a prima facie view that there is an element of profiteering, the standing sommittee shall refer the matter for a detailed investigation to the Director General of Safeguards, CBEC, which shall report its findings to the National Anti-profiteering Authority .

The Cabinet nod to the anti-profiteering body comes a week after the GST Council had slashed rates for 178 items (from 28 per cent to 18 per cent) in the GST regime. There are now only 50 items which attract 28 per cent GST.

A large number of items have witnessed a reduction in GST rates from 18 per cent to 12 per cent and some goods have been completely exempt from GST.

(with agency inputs)

No GST deduction on advances

- The government has exempted businesses from deducting GST on advances received for supplying goods in future, a move which will help unblock working capital of firms

- The Central Board of Excise and Customs (CBEC) last month said businesses with turnover up to Rs 1.5 crore are exempt from deducting GST on advance payment for supply of goods

- The CBEC, through a notification, has now extended this exemption to all businesses, except for those who have opted for composition scheme under the new indirect tax regime

Exporters can manually file claims

- The government has allowed exporters to manually file before tax officers claims for GST refunds as it looks to fast-track clearance of dues to ease liquidity stress faced by them

- Now exporters of services who paid IGST and those making zero-rated supplies to SEZ units as well as those merchant exporters who want to claim refunds for input credit can approach their jurisdictional commissioner with their refund form

- The decision has been taken due to the non-availability of the refund module on the common portal, the CBEC said