New Delhi, December 7

With RBI belying expectations of a rate cut, India Inc today expressed disappointment saying a rate cut was needed to provide fillip to the flagging industrial economy and stimulate consumption that has been hit by demonetisation.

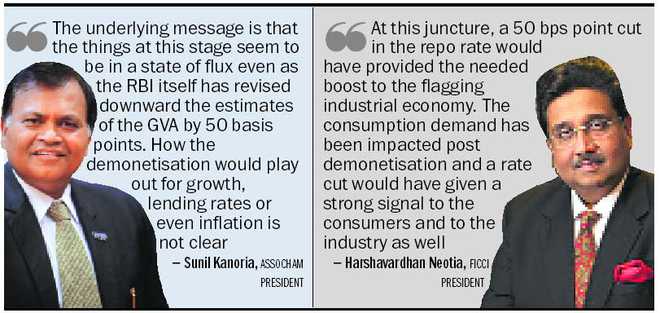

“At this juncture, a 50 bps point cut in the repo rate would have provided the needed boost to the flagging industrial economy. The consumption demand has been impacted post demonetisation and a rate cut would have given a strong signal to the consumers and to the industry as well,” Ficci president Harshavardhan Neotia said.

“Amidst a highly uncertain global environment, the impetus for growth will have to come from the domestic economy,” Neotia said.

Taking markets by surprise, the RBI today kept short-term lending rate unchanged even as the central bank lowered GDP growth rate to 7.1% and short-term disruption in economic activities due to demonetisation.

All the six members of Monetary Policy Committee headed by RBI Governor Urjit Patel voted in favour of the decision.

In view of disruption in economic activities due to demonetisation, RBI lowered growth forecast from 7.6% to 7.1% for the current fiscal.

“The underlying message is that the things at this stage seem to be in a state of flux even as the RBI itself has revised downward the estimates of the GVA by 50 basis points. How the demonetisation would play out for growth, lending rates or even inflation is not clear,” said Assocham president Sunil Kanoria.

EEPC India Chairman TS Bhasin said engineering exporters would look up to the central bank to restore normalcy in the domestic market by way of remonetisation of the currency.

“The exporting community is still facing problems with regard to production and reaching consignments to the ports. The exporters were also expecting some special window for the labour-intensive sectors at least with regard to lower rate of interest,” Bhasin said.

The headline inflation is projected at 5% by the fourth quarter of 2016-17 with risks tilted to the upside but lower than in the October policy review.

On demonetisation, it said, the withdrawal of old high value currency notes could transiently interrupt some part of industrial activity in November-December due to delays in payments of wages and purchases of inputs, although a fuller assessment is awaited. — PTI