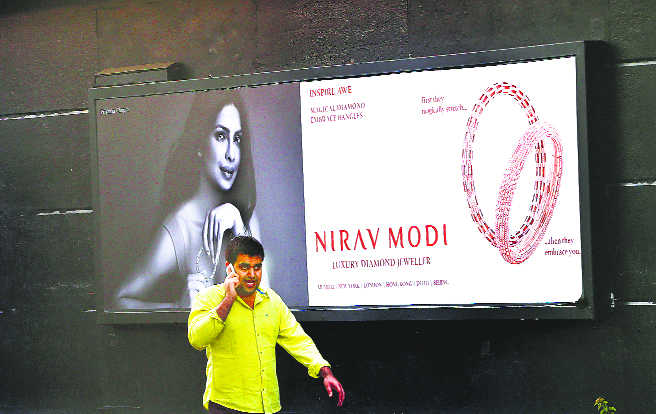

A man walks past a Nirav Modi showroom in New Delhi. REUTERS

Prabhakar Kulkarni

Senior journalist and columnist

Public and private banks in the country have direct relations with people. Depositors' and investors' amounts and public money provided to banks by way of recapitalisation for institutional survival in times of crisis of bad debts, are indicative of direct and indirect involvement of people. Any action in the matters of the current crisis of fraudulent deal of about Rs 11,000 crore disclosed now and previous bad debts of more than rupees twenty lakh thousand crores needs to be in public interest and people need not suffer for the fraudsters involved in the deals.

The PNB which is now flashed as a centre of the fraud and other banks are the institutions in which people have faith. All banks are being kept sound and safe by common people who deposit their money with the hope that their money is safe in banks. But bank officers and directors who rule banks, who are normally supposed to work as per rules and regulations, are not always following them strictly. They are susceptible to money baits and are directly or indirectly involved in corrupt deals.

The central regulatory authority of the Reserve Bank of India (RBI) is supposed to keep vigilance on these banks. But the RBI has no strict regulatory mechanism to keep track on various transactions in large network of banks' branches in various areas in the country. In fact, the RBI should have a sort of district or regional outreach with representation of people and experts around the area for due direction and vigilance on branches in the areas concerned. Failure to create such a mechanism seems to be one of the main reasons why scams and frauds, besides irregular disbursal of big loans and subsequent willful defaulters, have now surfaced creating a grave crisis.

In a fresh directive by the RBI, banks are asked to settle bad loans within 180 days, failing which banks will be fined or will face penalties. The restructuring facility is abolished and banks are asked to take insolvency proceeding if the defaulters fail to pay. In fact, bank officers have already resorted to restructuring of the defaulted loans, thereby being lenient to the defaulters. That they should not again resort to the same technique is quite a commendable restriction.

But now banks are warned of the penalty. In fact, public sector banks are owned by the government, which means indirectly by people in the country. Banks are institutional entities and, therefore, need not be punished for bank officials' failure or that of the director board. From sanctioning loans, that too of big amounts, to further restructuring and providing more facilities, the whole process is the prerogative of bank officials. Big defaulters (like Vijay Mallya) are wooed and offered loans on the pretext of 'consortium of finance' and sanctioning process, which is fully at the bank officers' discretion.

If such loans turn bad or borrowers turn in to willful defaulters, the responsibility lies on those who have sanctioned the loans. Their flaws or leniency, if any, in sanctioning such big loans need not be forced on institutions, but should be treated as their faults and they should be considered liable for action. If the banks as institutions are held responsible and action taken as fine or penalty, it amounts to penalty which people have to pay from the public exchequer.

Bank officers in almost all branches in the country are having two different criteria while sanctioning loans. The big loans to corporate bodies are sanctioned merely on a 'proposed project' under the concept of 'project finance' and that too by way of groups of banks under the concept of 'consortium of finance'. All big defaulters in both the public and private banks are found to be those who are given big loans under 'consortium of finance'.

The same concept of group finance or even that of 'project finance' is not considered if an educated unemployed person offers a project or wants finance for starting a project. He is asked to produce proof of his prospective success in the project or is turned down by officials with conjectural interpretation that such a project will not be successful. Small-scale industrialists, farmers and common borrowers are normally denied credit facilities on one pretext or the other.

So, if bankers are at fault in frauds and bad debts and in the sanctioning process, their liability should not be forced on institutions which are public and ultimately indirectly owned by people in the country. Deposits and public funding are the basis of banks' existence and hence they should be kept safe from any action against irregularities committed by officers and the concerned directors of banks, if they are found behind the alleged frauds and bad debts.

Penalise bankers at fault, not public

The recapitalisation of Rs 2 lakh crores or more amount is public money and that too is unduly a burden on people. If bank officers and the director boards who have sanctioned big loans without due care and restrictive rules (which are normally observed in cases of small loans like credit reports or Cibil credit recommendation), why should people or an institution as a whole suffer by way of penalty? Locate those who are responsible and find out what and where matters went wrong and impose fine if the individuals, whether directors or bank officers, are found liable for action.