Subir Roy, Senior journalist

Subir Roy, Senior journalist

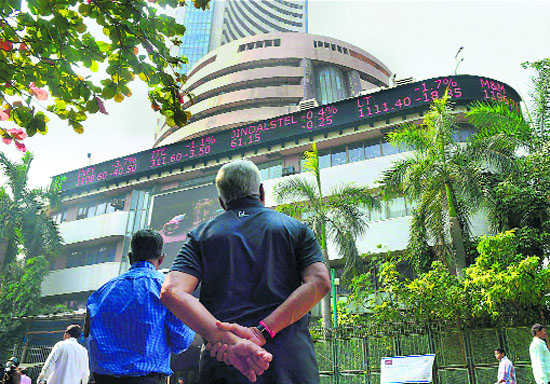

AT a time when falling interest rates for bank fixed deposits (FDs) have caused risk-averse middle class savers to turn to equity, it is important for the stock markets to exude a sense of steadiness and sobriety so that investment and growth progress healthily. The opposite has been the case as the current year has started off.

During January, the Sensex rose by a large over 5 per cent and in the first 10 days of February, lost almost as much. To take a longer perspective, during the previous year (2017), the index rose by a massive nearly 30 per cent, but during the previous five years (2013-17) by a steady compunded annual growth rate (CAGR) of nearly 12 per cent.

Thus, in February, the market has so far merely been correcting itself for the exceptional gains made in the previous month and year. But through this inevitable process, we have witnessed volatility which will drive away small new investors when it is necessary for them to stay put in order for the investor base to expand and the economy to have increasing access to risk capital.

Why the current volatality?

Why have we witnessed the current volatility? Finding an answer to that is necessary to devise a strategy to reduce volatility, if that is at all possible.

Favourable view of Modi govt: The sharp rise in January can be attributed to the markets taking a favourable view of the performance of the Narendra Modi government, endorsed by the IMF, and looking forward to a Budget that would like to please all, including the markets, in view of the coming elections.

In the event, the Budget appears to have pleased few and particularly not investors who have now been landed with a tax on long-term capital gains. The government's attempt to tax shareholders who book gains in the value of their stock investments over the longer term, thereby treating such gains the same way as income, acted as the trigger for the fall.

Effect of global markets: The other trigger is the fall in share prices across the world on most exchanges, particularly the US equity markets. This has dampened sentiments in India, too. This brings us up face to face with the reality of the Indian financial markets being now closely integrated with the global markets.

The key reason for markets across the world falling is the cue they have taken from the US markets which have not just passed a vote of no-confidence of sorts on the performance of Donald Trump's administration, but also his ability to properly shepherd the US economy, now that the good times are ending. This is because of the sense that the days of easy money are numbered. The unemployment rate in the US has sunk to remarkable lows and wages have started creeping up. This signals the advent of tight money down the line in anticipation of inflation which will naturally put an end to the cash that has been lying around ever since central bankers sought to put behind themselves the great recession of 2008.

Longer term causes

Indian stock valuations have forged ahead of the companies' ability to support them: Other than these proximate causes of the present downturn, there are two longer term causes which are more serious. One is that Indian stock valuations have forged ahead of the companies' ability to support them. The price earning ratios of Sensex stocks have gone up by over five percentage points in as many years to reach 23.8 in 2017-18. This subsumes very high valuations of many leading stocks and the sense is that this is not sustainable. So, for the ratio to come down, prices will have to do so as further upside for earnings is limited.

Dim growth prospects for global economy: The other long-term dampener is growth prospects for the global economy. There is no certainty as to how oil prices will behave next year. Even more daunting, prospects for growth in global trade are right now straightforwardly dim, what with President Trump openly declaring that for him America comes first and he would not be working for secular growth in trade which brings all-round growth and prosperity.

Right now, the prospects for Indian markets and those around the world picking up handsomely in the medium term appear dim. This is likely to affect valuations adversely and shoo away small investors looking for value.

What can be done?

One traditional weapon, prop up the markets with support from public financial institutions like the LIC, is not what it used to be, with the government disengaging itself from its older command and control role. Plus, the ability of the Indian authorities to get enough bang for the buck for the support the institutions can provide to the market has become limited with capital controls having been whittled down over time. The Indian authorities are quite unlikely to put themselves in a position where they are posited against foreign fund flows.

What is the outlook ahead?

The market is unlikely to be clear as to which direction it seeks to go. It is likely to go up and down with a degree of volatility and reflect the uncertain prospects that the global economy faces and also the electoral uncertainty before India. The Indian authorities should, therefore, give up any ideas that they may have of holding out prospects before the Indian investor of a good growth in equity valuations and try not to promote equity as an asset class.

Ironically, there is likely to be little capital gain in the medium term for the new tax to put its teeth into. If you are not already invested in leading scrips at valuations far lower than current levels, then stay away from stocks.