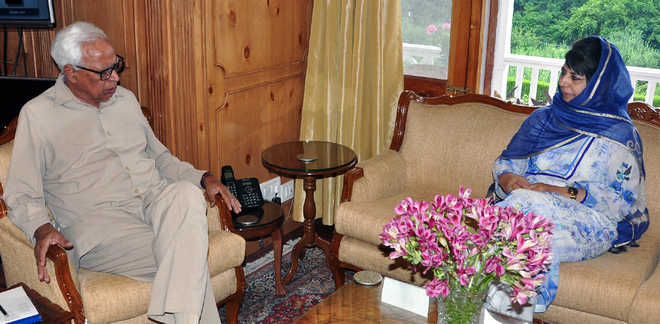

CM Mehooba Mufti with Governor NN Vohra.

Sumit Hakhoo

Tribune News Service

Jammu, June 19

With the rollout of the goods and services tax (GST) by the PDP-BJP coalition government in doubt, huge “economic chaos” loom large if the single tax regime across the country is not implemented by July 1 in the state.

Economists, trade and industries bodies in the Jammu region fear devastating effects on the manufacturing sector and pricing of goods imported and exported from J&K if the state fails to be part of the single tax system.

After the special session of the Legislative Assembly was adjourned sine die by Speaker Kavinder Gupta on June 17 without the passage of legislation, the business community fears economic losses in coming months.

Though the government constituted an all-party committee to debate the GST before the introduction of a legislation in the Assembly, no deadline has officially been set for the report of the committee.

The new tax system cannot be implemented directly in J&K by virtue of its special status under Article 370. The Constitutional (Amendment) Act passed by Parliament is not directly applicable to J&K thus the Legislature has to pass its own draft/Act. Unlike other states, J&K has the power to tax both goods and services but under the new GST regime a single taxation system.

“It will create a confusion in the state. There will be issues of double taxation. Non-implementation will lead to creation of two markets — J&K and India. Consumers will ultimately pay the price,” said Prof Deepankar Sengupta from the Economics Department, University of Jammu.

Trade bodies in the Jammu and Kashmir regions have opposing stands on the issue. While the Chamber of Commerce and Industry (CCI), Jammu, has sought the GST’s implementation, the business community in Kashmir has opposed it citing the special status of J&K.

“There is no other way but to integrate with the single tax regime from July 1. How will traders from J&K get goods from outside the state if the billing is not done under the GST,” said Rakesh Gupta, CCI president.

The fear of trading and business community is genuine as before the GST is implemented every trader has to be registered and get a separate identity number which has to be mentioned on the bills.

“Manufacturing units and industries will not be able to bring raw material from outside the state. The worst-affected will be the Jammu region as it has the majority of industries and private investment. We won’t even be able to send material outside the state,” said Rajiv Mahajan, president, Bari Brahmana Industries Association.

Existing Central taxes include excise duty, service tax and additional customs duties, the state taxes comprise entertainment tax, luxury tax, lottery taxes, electricity duty, Central sales tax, octroi and value-added tax. The GST will cut down the large number of taxes imposed by the Central government and states and will lead to the creation of a unified system.

Governor, CM discuss rollout of tax regime

Srinagar: Chief Minister Mehooba Mufti met Governor NN Vohra and briefed him about the consultations which had been done and the action underway to finalise the GST framework. Pointing to the consequences of the continuing delay in regard to this important issue, the Governor advised timely decisions being taken in the interest of safeguarding J&K’s economy and the welfare of people. The Governor also discussed with the Chief Minister the continuing terror attacks on police personnel and urged her to review the existing policy and scales of help provided to the next of kin of those killed in the line of duty. And, as required, he would also take up this matter with the Union Home Minister. The other matters discussed by the Governor and the Chief Minister included the recent allegations about the functioning of the State Public Service Commission, the time frame of elections to panchayats and urban local bodies and filling up of vacancies in the state-level commissions. TNS