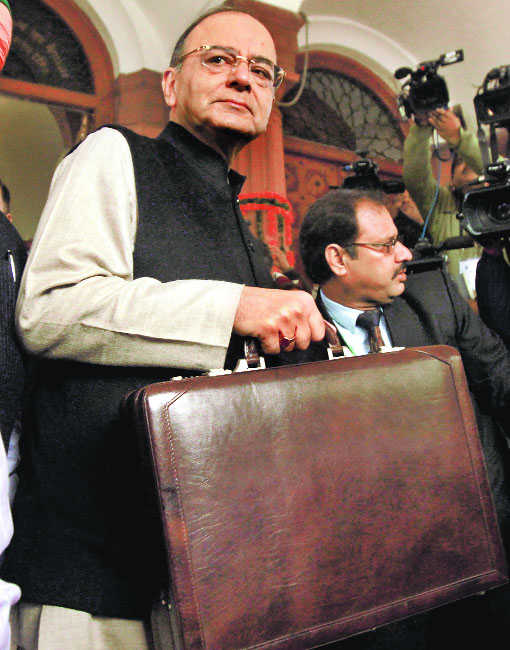

Tribune Photo: Mukesh Aggarwal

New Delhi, February 1

In a pre-election Budget aimed at softening the demonetisation blow, Finance Minister Arun Jaitley today halved the basic income tax rate to 5 per cent and lowered the rate for small companies, while boosting spending on rural employment, agriculture and infrastructure.

Edit: An incremental budget

Jaitley presented a merged railway and general Budget after advancing the dates by a month that provides a record outlay of Rs 3,96,135 crore for infrastructure schemes, besides a capital expenditure of Rs 1.3 lakh crore on railways and Rs 64,000 crore on highways.

The FM perhaps was asked to build on the political gains of demonetisation, and that is why sections hurt by it were targeted for incentives. Small and medium enterprises got a tax cut and taxpayers were rewarded — though not to the extent expected. And much against expectation again, the Budget lacked the surprise factor.

(Follow The Tribune on Facebook; and Twitter @thetribunechd)

The Budget seeks to provide a record Rs 10 lakh crore in loans to farmers, boost funds for rural employment guarantee programme, bring one crore households out of poverty and promised to build one crore houses by 2019 for the homeless ahead of the crucial elections in five states.

In view of the fact that the proposed GST is expected to be rolled out soon, he left indirect taxes largely untouched.

While the tax rate for income between Rs 2.5 lakh and Rs 5 lakh has been lowered to 5 per cent, a 10 per cent surcharge has been slapped on income between Rs 50 lakh and Rs 1 crore. The 15 per cent surcharge on income above Rs 1 crore will continue.

The tax liability of all persons below Rs 5 lakh would be reduced to either zero (with rebate) or 50 per cent of the existing liability. In order not to have duplication of benefit, the existing benefit of rebate available to them is being reduced to Rs 2,500 available only to assessees up to income of Rs 3.5 lakh.

While the taxation liability of people with income up to Rs 5 lakh is being reduced to half, all other categories of taxpayers in the subsequent slabs will also get a uniform benefit of Rs 12,500 per person.

In the case of senior citizens above 60 years, there will be no tax up to Rs 3 lakh, while the exemption will be up to Rs 5 lakh in case of citizens above 80. Both the categories will attract a tax of 20 per cent on income between Rs 5-10 lakh and 30 per cent for income above Rs 10 lakh. — Agencies

Fiscal deficit down to 3.2% from 3.5%

New Delhi: Moving ahead with the fiscal consolidation path, Finance Minister Arun Jaitley has pegged the fiscal deficit for 2017-18 at 3.2 per cent, down from 3.5 per cent expected in the current financial year. Addressing the media, he said the Budget estimate for fiscal deficit was 3.5 per cent for 2016-17 and revised estimate is also 3.5 per and it will be achieved. Fiscal deficit is the difference between revenue receipts plus non-debt capital receipts (NDCR) and total expenditure. This indicates the total borrowing requirements of the government from all sources. Fiscal deficit of 3.2 per cent in absolute terms for the next fiscal comes out to be Rs 5,46,532 crore. PTI

Affordable housing gets infra status

New Delhi: Aiming to boost real estate sector, the government announced infrastructure status to affordable housing for encouraging investment and offered tax sops to developers sitting on completed but unsold homes. The allocation for Pradhan Mantri Awaas Yojana- Gramin has also been raised. PTI

Incentives to boost investment in NPS

New Delhi: In a bid to boost NPS, Finance Minister Arun Jaitley has proposed higher tax rebate for investment in flagship social security programmes and allowed tax relief on partial withdrawal of up to 25 per cent of the contribution. PTI

Now, tax exemption to CM, LG relief funds

New Delhi: The government announced extension of tax exemption on contributions to Chief Minister’s Relief Fund and Lieutenant Governor’s Relief Fund. At present, there is tax exemption on funds given to Prime Minister’s National Relief Fund. Jaitley said Chief Minister’s Relief Fund (CMRF) and Lieutenant Governor’s Relief Fund (LGRF) are of the same nature as the Prime Minister’s National Relief Fund at the level of state or the union territory. “Therefore, it is proposed to amend the said clause so as to provide the benefit of exemption to the Chief Minister’s Relief Fund or the Lieutenant Governor’s Relief Fund,” he said. This amendment to I-T Act will take effect retrospectively from April 1, 1998. PTI

Railways: Rs 1,31,000 cr

Railway lines of 3,500 km will be commissioned and at least 25 stations are expected to be awarded for station redevelopment in 2017-18

BANKING SECTOR: Rs 10,000 cr

To be injected into state-owned banks as capital in the coming fiscal as compared to Rs 25,000 crore budgeted for the current year

Agriculture: Rs 51,026 cr

To be used to double farmers’ incomes in five years and set up two dedicated funds of Rs 13,000 crore to promote micro-irrigation and dairy processing

Health: Rs 48,853 cr

To ensure availability of specialist doctors at the secondary and tertiary levels, creation of additional 5,000 post- graduate seats every year

Defence: Rs 2,74,114 cr

Out of this amount, Rs 86,488.01 crore is for capital outlay meant for acquisition of assets such as aircraft and tanks for the defence services

Video courtesy: PIB youtube channel