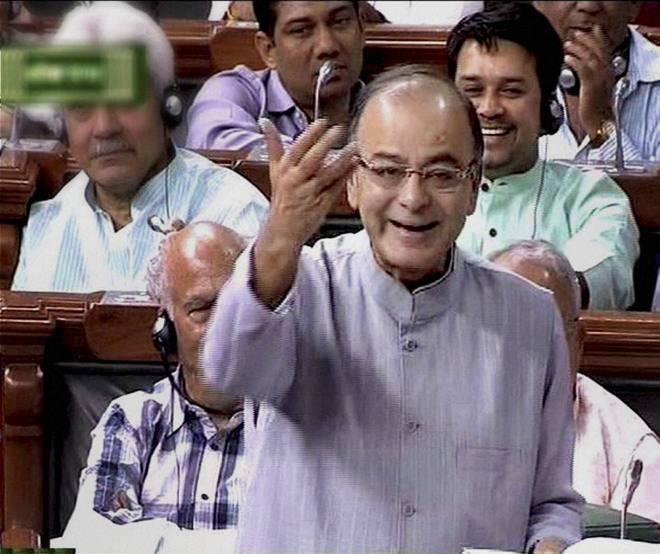

Finance Minister Arun Jaitley speaks in the Lok Sabha in New Delhi on Wednesday. PTI photo

Aditi Tandon

Tribune News Service

New Delhi, May 6

The BJP government today crossed its first milestone on the road to economic reforms with the Lok Sabha passing a historic Bill to subsume all existing central and state taxes under a single goods and services tax (GST) with a potential to reduce corruption and boost trade.

The Constitution (One Hundred and Twenty-Second) Amendment Bill 2014, popularly called the GST Act, was required to be passed with the majority of the total membership of the House — more than 272 votes in a 542-member House — and the majority of not less than two-thirds of the members present and voting.

It was carried with 352 votes in favour and 37 against with the principal Opposition Congress walking out before the vote, signalling a tough road ahead for GST in the RS where the BJP is heavily outnumbered.

The Bill that was passed today includes eight government amendments moved by Finance Minister Arun Jaitley, who described GST as a system of indirect tax with the least harassment and evasion.

Allaying fears of the Congress, AIADMK, Shiv Sena and CPM that states would lose taxes in the new system, Jaitley urged MPs to shed their “fear of the unknown” saying he didn’t foresee states losing revenue.

“With this law, the country — one-sixth of the world’s population — will become a common market. Besides being the destination tax, GST would involve uniform taxation throughout India; seamless transfer of goods and services; fillip to trade and end of tax on tax,” Jaitley said as PM Narendra Modi gave the voting on his government’s first major constitutional amendment Bill a miss as did ministers Sushma Swaraj, Smriti Irani and Venkaiah Naidu, much to Opposition’s angst.

Presently, layers of taxes are levied on goods and services -- there is tax on raw material, then excise duty, entry tax at state level and VAT.

“The regime of tax on tax made goods costlier. We want a system which brings inflation down and boosts India’s GDP,” Jaitley said amid projections of 2 per cent gain in GDP growth with GST roll-out.

The roll-out is planned by April 1, 2016 but only after the Congress-dominated Rajya Sabha passes the Bill followed by half of India’s 29 states.

On Congress’ "doublespeak" as articulated by former minister Veerappa Moily who said his party favoured the GST but wanted it referred to a parliamentary committee, the Finance Minister had objections.

“The Congress must take an honest position or whether or not it wants the GST. I have agreed to suggestions of the parliamentary committee you also mentioned in your comments. Why do you still want the Bill sent back to the panel whose recommendations I have already incorporated? The Bill is not a dancing instrument that it will jump from panel to panel. What is this 'kabhi haan kabhi naa'…It will be erroneous to see this Bill as a UPA versus NDA issue. It is a Centre-state issue,” Jaitley said, leaving a smile on Congress president Sonia Gandhi’s face moments before she walked out.

For RSP’s NK Premachandran, who had genuine concerns over the law giving the President the power to amend the Constitution, Jaitley had generous praise. “Premachandran does his homework very well. But I assure him that this law gives the President the power only to remove difficulties as many other laws do including the 44th Constitutional Amendment which nullified the 42nd amendment of the Emergency time,” Jaitley said.

The Bill came through after the government agreed to exclude potable alcohol and petroleum from its ambit after states said they wanted to retain these revenue-earning items. Petroleum won’t be covered by GST until the GST Council approves such coverage with 3/4th vote -- 1/3rd of the Centre and 2/3rd of the states.