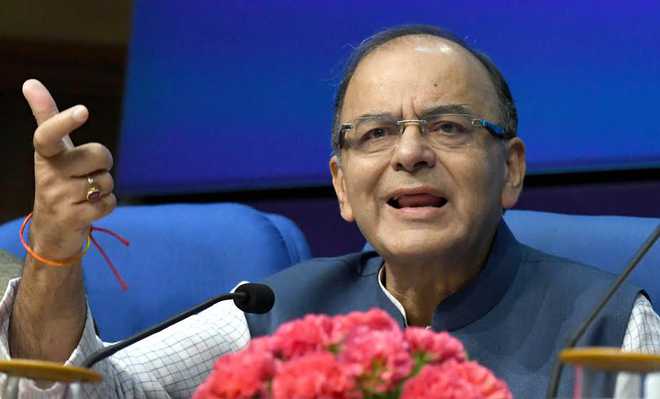

The FM made the announcement. Tribune photo: Manas Ranjan

New Delhi, October 1

In the biggest-ever black money disclosure, at least Rs 65,250 crore of undisclosed assets were declared in the one-time compliance window, yielding Rs 29,362 crore in taxes to the government.

While the black money declarations will go up once all the online and manual filings of undisclosed assets filed at the end of the four-month window on September 30 are compiled, the government will get nearly Rs 14,700 crore or half of the due taxes, this fiscal.

Announcing the declarations made under the Income Declaration Scheme (IDS), Finance Minister Arun Jaitley said 64,275 declarants disclosed an amount of Rs 65,250 crore.

(Follow The Tribune on Facebook; and Twitter @thetribunechd)

“Some disclosures have not been tabulated ... this figure could be revised upward once the final tabulation is done,” he told a news conference here.

The government had offered a one-time chance to holders of income and assets that had illegally escaped taxes, to come clean by paying a tax and penalty of 45 per cent.

On the declarations compiled so far, the government will get Rs 29,362.5 crore in tax and penalty. The declarants can pay this amount in two instalments up to September 30, 2017.

Half or Rs 14,681.25 crore will accrue this fiscal.

Last year, under a similar scheme for foreign black money holders, 644 declarations of undisclosed foreign income and assets were received, and just Rs 2,428 crore was collected in taxes.

“We will maintain secrecy of these declarations,” Jaitley said, adding the tax would accrue to the Consolidated Fund of India and would be used for welfare of public.

The average declaration per declarant comes to Rs 1 crore.

A total tax of Rs 9,760 crore was collected under the Voluntary Income Disclosure Scheme (VIDS) amnesty scheme brought by the then Finance Minister P Chidambaram in 1997.

“In 1997, the tax collected was Rs 9,760 crore,” Jaitley said, adding that VDIS and IDS cannot be compared as the two schemes are different.

While IDS is not an amnesty scheme, VDIS provided blanket amnesty, he said. Taxation under IDS is charged at the rate of 45 per cent while the effective rate of tax in the 1997 scheme was in single digit.

Jaitley also listed out the steps taken by the government to unearth unaccounted money in over two years, including Rs 56,378 crore during search operation and Rs 16,000 crore from non-filers of tax returns. — PTI