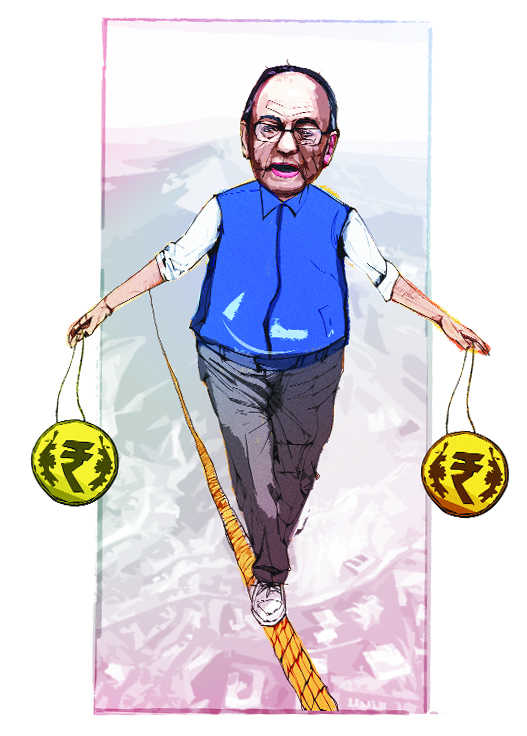

Illustration: Vishal Prashar

New Delhi, February 1

Giving relief to the salaried class, Finance Minister Arun Jaitley today proposed a standard deduction of Rs 40,000 in lieu of transport allowance and medical reimbursement entailing a revenue sacrifice of Rs 8,000 crore. The minister, however, did not propose any change in the tax slabs or rates for individual taxpayers.

“In order to provide relief to salaried taxpayers, I propose to allow a standard deduction of Rs 40,000 in lieu of the present exemption in respect of transport allowance and reimbursement of miscellaneous medical expenses,” Jaitley said while presenting the Budget 2018-19 in Parliament today.

The standard deduction, which is provided to salary earners, was discontinued from the assessment year 2006-07.

However, it will provide little relief to salaried class as benefits under the proposed Rs 40,000 standard deduction will be neutralised to a large extent by inclusion of transport and medical allowances and 1 per cent hike in health and education cess.

Already the individual tax payer was getting benefit of Rs 19,200 under transport allowance and Rs 15,000 crore under the medical allowance. Both these components add to the tax benefit of Rs 34,200 crore per annum.

So, the effective tax gain is to the tune of Rs 5,800 per annum with the introduction of standard deduction.

According to Parizad Sirwalla, partner (tax), KPMG, the withdrawal of annual tax free transport allowance and medical reimbursements has squared off the benefit on account of standard deduction.

“An annual incremental net reduction of Rs 5,800 in income results into tax savings of Rs 302 and Rs 2,081,” Sirwalla said.

At the same time, Sirwalla said, maximum tax rate overall has increased to 35.88 per cent from existing 35.53 per cent taking into account 1 per cent increase in education cess.

“In order to provide relief to salaried taxpayers, I propose to allow a standard deduction of Rs 40,000 in lieu of the present exemption in respect of transport allowance and reimbursement of miscellaneous medical expenses,” Jaitley said in his Budget speech.

This decision to allow standard deduction shall significantly benefit the pensioners also, who normally do not enjoy any allowance on account of transport and medical expenses, he said.

Jaitley also noted that there is a general perception in society that individual business persons have better income as compared to salaried class. However, income tax data analysis suggests that major portion of personal income-tax collection comes from the salaried class, he observed.

The total number of salaried employees and pensioners who will benefit from this decision is around 2.5 crores. — PTI

Experts opine

Reintroduction of standard deduction will help salaried employees get some parity with respect to businessmen and other self-employed professionals, who can claim a number of expenses such as rent, staff expenses and driver's salary etc. as business expenditure and reduce tax burden.

No change in income tax slabs

The Finance Minister did not propose any change in the tax slabs or rates for individual taxpayers. He said the government had made many positive changes in the personal income-tax rate applicable to individuals in the last three years. “Therefore, I do not propose to make any further change in the structure of the income tax rates,” he said.

Investment limit up in vaya yojana

It is proposed to extend the Pradhanmantri Vaya Vandana Yojana (PMVVY) scheme till March 2020. It has also proposed to increase the current investment limit to Rs 15 lakh from the existing limit of Rs 7.5 lakh per senior citizen. PMVVY was launched on May 4, 2017, and was initially meant to be available for one year from the launch.

Team-based scrutiny of I-T returns

In order to bring in greater transparency and accountability, the Budget proposed to introduce team-based assessment to determine tax payable or refunds to be issued to an assessee from April 1. An e-assessment of tax returns was introduced on pilot basis in 2017 and extended to 102 cities later.

No bills required to claim deduction

- Salaried taxpayers and pensioners need not have to furnish any bills or documents to claim the standard deduction of Rs 40,000, according to CBDT chief Sushil Chandra

- Till now, this category of taxpayers had to furnish medical bills and an undertaking for conveyance expenses to get benefit of Rs 19,200 under transport allowance and Rs 15,000 crore under the medical allowance

- Chandra said the new measure will benefit all salaried employees, without the hassle of filing supporting documents or bills. The Central Board of Direct Taxes (CBDT) is the policy-making body of the Income Tax Department