features

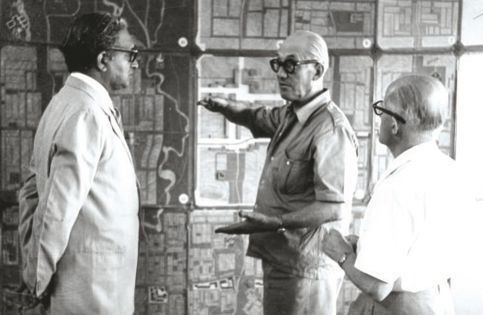

PL Varma: Soul of Chandigarh

If Corbusier was the face of the project to build a new capital city, PL Varma was its lodestar. A tribute to the master builder and his team of engineers

Yes to banana: Every bit of the plant can be used

Each and every bit of the banana plant is used by humankind ...