S.C. Dhall

Competition among banks and lenders offering home loans seems to be hotting up in the country over the past three weeks as the lending rates have been cut across the board.

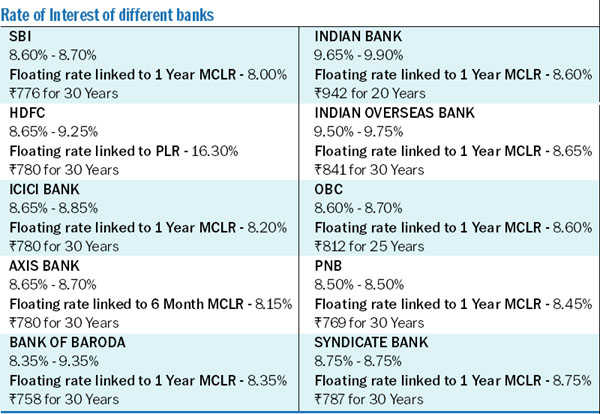

Following State Bank of India’s recent announcement of reduction in lending rates for home loans by 50 basis points to 8.60 per cent (for floating rate loans), various lenders followed suit, effectively setting off a price war in the Rs 13 lakh crore home loan market. Key lenders that together account for over 65 per cent of the home loan market, now offer interest rates in the range of 8.5-8.7 per cent after the reduction, compared with their earlier rates of 9.1-9.3 per cent .

HDFC, ICICI and Indiabulls are all offering an interest rate of 8.65 per cent to women borrowers and 8.7 per cent for other borrowers, on loans up to Rs 75 lakh.

While the lower rates are applicable only for new loans and loans linked to the marginal cost of funds-based lending rate (MCLR), to retain existing borrowers they are usually given the option to shift to a lower interest rate by paying a fee which could lead to dilution in yields for the lenders.

However, Bank of Baroda (BoB) seems to have outsmarted private sector rivals and even largest public sector bank State Bank of India with regard to home loan rates by offering the lowest in the industry at 8.35 per cent. The bank is actively luring borrowers who are stuck with rivals who are not passing on their low rates to existing borrowers, but only to new customers.

The new rates are the lowest among all public and private banks, non-banking financial companies and housing finance companies.

However, the offer comes with a catch. This rate will only be available to customers with a credit score of 760 or more. Customers with a lower credit score will have to pay a higher rate of interest. This pioneering step by BoB marks a shift towards risk-based pricing of loans, making it incumbent on everyone to pay heed to their credit score

The bank also waived off the switching fee to convert a base rate loan to the cheaper MCLR structure.

Currently, borrowers have to pay anywhere between Rs 5,000 and Rs 10,000 as a switching fee to get loans converted to the new regime. Existing home loan borrowers of other banks and housing finance companies will also be able to transfer their loans to BoB free of cost.

On a home loan of Rs 50 lakh, reduction in interest rate by 0.70 per cent by the bank will help a homebuyer save Rs 2,496 per month and approximately Rs 9 lakh during the loan tenure of 30 years.

After announcing the lowest lending rate on home loan in industry, BoB is turning aggressive to grow its housing loan portfolio. It expects to disburse around Rs 2,500 crore in the fourth quarter of this financial year, ending March.

The ongoing reduction in lending rates could lead to increased competition and balance transfers in the highly competitive housing loan market, especially in the prime salaried segment.

The impact on spreads of housing finance companies (HFCs) to be much higher if they were to attempt to match the rates offered by banks, given the latter’s lower cost of funds and excess liquidity post-demonetisation. As 60-65 per cent of the borrowings by HFCs are at fixed rates of interest, and the assets are largely floating, spreads could shrink over the medium term.

There is a rate war among lenders in the home loan segment, but the demand for fresh loans is restricted to the segment below Rs 25 lakh. In the larger ticket size segment, the demand is more for balance transfer and hence the competition among lenders to offer better rates. Some lenders even offer a marginally lower rate than card rates in case of balance transfers. Customers must keep this in mind and also the tenure left on their existing loan before transferring it.

Most home buyers are not economists. In fact, most of us would go only as far as to calculate the total cost of a home, hurry up to avail of a loan and seal the deal as soon as possible. However, being naïve about the process and the long-term expenses involved in it might sometimes impact our finances in a big way — something the common man cannot afford.