The big question: What good is RBI supervision, not to speak of an audit by its officials, if it does not have a clue to what is really happening?

Subir Roy

Senior economic analyst

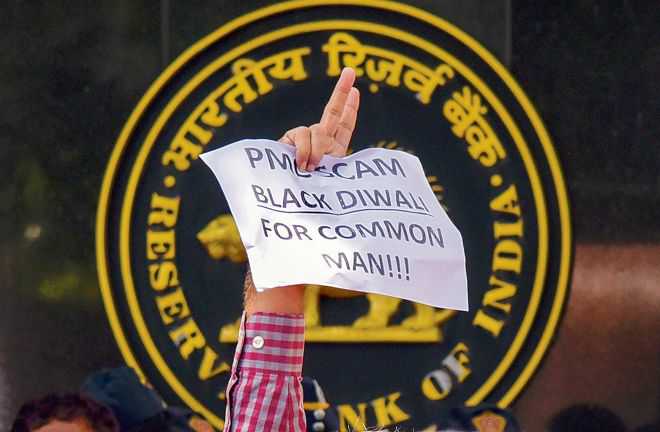

Last week, the head of India’s monetary authority, RBI Governor Shaktikanta Das, said, ‘Indian banking sector remains sound and stable and there is no reason for any unnecessary panic.’ The need for him to make such an extraordinary assertion underlines the level of disquiet that is working through the system.

The disquiet is at two levels. After the Punjab and Maharashtra Cooperative Bank (PMC) has had to go into intensive care, the sight of the humblest queuing up distraught to get back their meagre savings is making depositors across the country ask what the future of their own savings is. This is the antithesis of the trust on which the banking system runs — people leaving their money with the banks so that they can lend to businesses and let the wheels of the economy turn.

The second is fundamental and systemic. Flow of funds to the commercial sector appears to have collapsed. During April to mid-September this year, it was Rs 90,900 crore, an unbelievable one-eighth of Rs 7.36 lakh crore clocked in the same period last year. If funding to the commercial sector dries up in this manner, it must cause economic activity to grind down, severely impacting incomes and jobs.

What we may be seeing is a vicious cycle at work. The real estate sector, a major client of non-banking financial companies (NBFCs), is in trouble (this predates the NBFC crisis), leading to its players’ inability to service their debts, causing the asset quality of their NBFC lenders to decline. This prevents them from accessing funds the way they used to. The Infrastructure Leasing and Finance Services (IL&FS) collapse along the way adds to this. So, the NBFC funds get costlier and harder to come by. The result is the inability to keep up the earlier pace of lending.

This contributes to the growing economic slowdown which hits commercial operations across the board in the economy, making companies unable to repay their loans, not just to NBFCs, but also banks. So, there is a decline in the asset quality of banks, too, and their focus shifts to mending their balance sheets instead of growing them. As a result, less bank money is coming to NBFCs.

To understand why we are in such a bind, let’s get back to where it began, the collapse of the IL&FS, precisely a year ago. The fact that this could happen to a quasi-government operation sent shock waves through the non-bank or NBFC sector, drying up the rollover of their short-term loans with which they had financed long-term loans to the realty sector, causing the asset liability mismatch.

A year later, the NBFC sector is yet to recover as mutual funds and banks are still reluctant to lend to them. The risk premium over government bond yields that banks are charging has increased despite repo rate cuts in the intervening period, indicating continuing risk aversion among the lenders to NBFCs.

Plus, most recently, the sector has been hit by the RBI stepping in at the PMC Bank, a major interstate cooperative bank, leading to the arrest of its former chairman and the managing director, as also the father and son duo, owners of Housing Development and Infrastructure Ltd. They had the run of the bank, accounted for a huge portion of its lending, and their default has brought the house down.

How do we get back to sanity and good health for the financial sector? (We were in fact on the road to recovery with banks on the mend, lowering their NPAs, when the PMC Bank setback hit.) A good place to begin will be to look at why cooperative banks are so wayward.

Their ill luck lies in having to live with dual regulation. The RBI supervises and the cooperative operations of ministries at the Centre and the states oversee their management and monitoring. (PMC Bank, for example, being a multi-state cooperative, is managed by the cooperative department of the Union Agriculture Ministry.) Plus, critically and locally powerful politicians wield influence through boards whose directors are elected by the cooperative society members.

One way to solve this mess is to introduce a new layer — a board of management — between the board of directors and the line management, with independent professional directors accountable to the RBI.

If an independent board is one watchdog, cooperative banks must have to ensure they mind the interests of stakeholders. Another watchdog whose health needs examining is the auditors. IL&FS, EY India, KPMG and Deloitte Haskins and Shell are facing a possible ban on account of their inability to deliver. Spot the rot before it bursts open.

Another watchdog group which has fallen down in the case of IL&FS is the rating agencies. The chief executive of ICRA has been sacked and that of CARE has been sent on leave and is being investigated. If downgrades take place after the damage has been done, what benefit is there in paying for a rating that merely encourages complacency?

The spotlight also needs to be on the RBI. What good is RBI supervision, not to speak of audit by its officials, if it does not have a clue to what is really happening? The RBI has to greatly improve its ability to gather market intelligence, so that it can step in before all the liquid assets have been squirrelled away and a collapse takes place. Right now, the RBI is mostly made up of officials who have spent their professional lives within the RBI and know no way of tuning their ears on to market gossip that can signal danger ahead.