GST council fixes rates: The GST rates bear the imprimatur of the ruling parties, both at the Centre and the states.

Subir Roy

Columnist and author

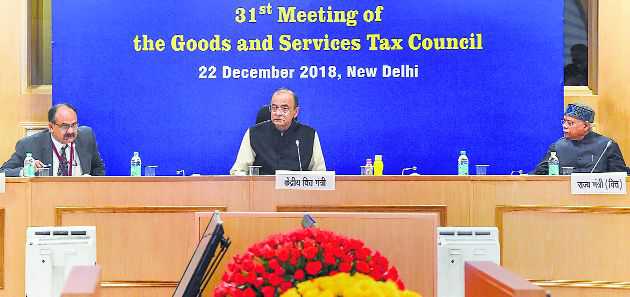

The lowering of nearly two dozen GST (goods and services tax) rates at the meeting of the GST council last week can be traced to the setback the BJP met with in the five Assembly elections. The results were an early warning for the ruling party at the Centre, with Parliament elections due in less than half a year.

For four years, the Narendra Modi government had displayed a strong sense of fiscal responsibility (resisting agricultural loan waiver, for example) and showed a strong commitment — making it almost a fetish — to its own fiscal deficit target. It was able to do this partly because of low international oil prices for most of its rule.

But now that oil prices have become volatile and the need to distribute pre-election goodies is imperative, GST is a good, ideologically neutral area to turn to.

The GST rates, determined by the GST council, bear the imprimatur of the ruling parties, both at the Centre and those at the states, and none can seriously question them.

This has not prevented the Congress from criticising the latest changes on the ground that despite them, the tax regime remains too complicated and continues to be implemented poorly. Not unexpectedly, Finance Minister Arun Jaitley has called the Congress comments irresponsible.

The benefits of GST

To understand what is happening, let's get back a bit to the basics. GST is a universally accepted good thing as it replaces a multitude of state and central indirect taxes with a single tax and over time, works towards just a few rates (ideally a single one) of a single tax. This eliminates cascading (tax on tax) and tax disputes resulting from the multiplicity of rates.

It translates into a lower tax on what consumers buy, greater buoyancy in tax revenue and, perhaps, most important, efficiency gains from businesses having to fight fewer tax disputes. The latter should lead to better margins which should get passed on to consumers through lower prices.

Since this is such a good thing, everyone should want it, except perhaps state governments which have to give up a part of their right to levy taxes to collective decision-making (GST council), of which they are a part.

All central governments, irrespective of their hue, should love it and they have done so and the same parties have opposed it when in opposition!

The idea of instituting GST was first introduced by Atal Bihari Vajpayee in 2000 and P Chidambaram as Finance Minister set a deadline for its implementation in his 2006 Budget speech. The Bill to amend the Constitution to bring in GST was finally passed by the Rajya Sabha in 2016, with the BJP and the Congress cooperating.

But somewhere inbetween, Modi, as Gujarat Chief Minister, had opposed GST in 2013 and the Congress, now in opposition, in late 2014.

When GST caused disruption

When GST was introduced last year, it created a huge disruption, particularly among small businesses as they simply did not have the wherewithal to submit online returns as they had access to neither the GST tax experts nor the information technology infrastructure.

Exports also suffered because of delays in getting refunds.

The twin blows dealt by demonetisation and introduction of GST to small businesses and those who depended on them (life at the bottom of the pyramid) constitute the two biggest setbacks of the Modi government.

The government has been criticised for introducing GST without adequate preparation. But it is also possible to argue that GST is an inherently complicated matter, involving a huge amount of calculations and detailed invoicing to be transmitted digitally, and you cannot get away from the hiccups by endlessly preparing for it. So, at some point, you have to take the plunge and then keep removing the glitches as you go along.

Once you have come some way and can sight some of the gains, you will feel that it has been worth the trouble. Modi, who is a bold risk-taker, took the plunge.

The gains from GST

By lowering the GST rates for several commodities from the high 28 per cent to 18 per cent and holding out the hope that eventually the system may move towards a single standard rate of 15 per cent, Jaitley has prepared the ground for the prices of several items going down, some of them of mass concern like cinema tickets and TV screens.

The catch with this is it will likely adversely affect tax revenue in the short run. In the longer run, with rising consumption, things should even out or even get better.

Centre vs states

As the GST proceeds are shared between the Centre and the states, it will hit tax revenues for both.

Now, the states have no cushion and are distinctively unhappy. The Centre, on the other hand, has a lot of cushion. It can take recourse to a lot of extra budgetary devices to overcome a cash crunch which the states do not.

For example, without rescuing IDBI Bank with a big cash injection, the Centre got LIC to take it over. This is not good for LIC's policy-holders (IDBI Bank will never be a good investment for LIC), but the chickens will come home to roost after some time.

Thus, the GST rate cuts will adversely affect the states the most for the time being while the BJP government at the Centre will be able to wave this as a pro-people gesture in the run-up to next year's elections. This is a win-win move for the Centre, but the reality may turn out to be a lot different over time.

For example, when demonetisation came, it was speculated that one reason behind the BJP going in for it was that it would render useless all the black money that the opposition parties had and cripple them. (The BJP of course bought up a lot of real estate across the country just before demonetisation).

But as the Assembly election results indicate, they are hardly crippled.