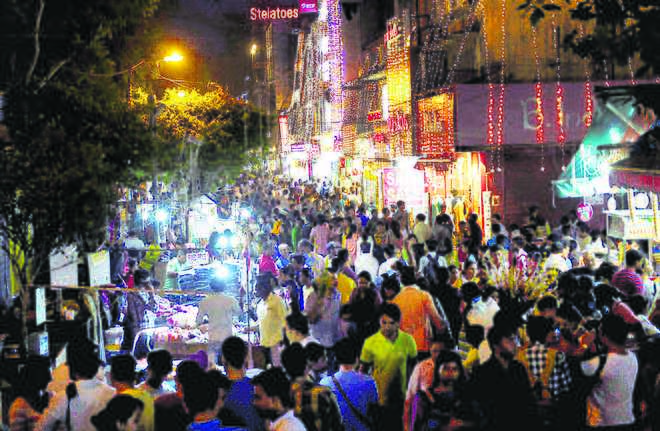

FESTIVE SEASON: It is the time when the retail market perks up.

Bhanu Pande

Senior business journalist

AMIDST all the noise around the rising crude prices, weakening rupee and plunging Sensex over the last few months, a couple of things are being ignored. These glaring challenges have hit the country at a time when retail inflation is still very much under control, hovering around 4 per cent or less, GDP growth stands at a healthy 8 per cent or thereabout, and there's a brisk consumer spending still. Ask any big retailer, both in modern trade and e-commerce, neither has felt any jolt on the consumption pattern. This, they feel, will sustain. And that should give the government some leeway and manoeuvring strategies to bring the country out of the economic morass.

As per the last round (September) of the Consumer Confidence Index data released by the RBI, while negative over the previous round, expectation for the year ahead looks healthy and positive. Income and spending variables remain positive, though with some caution. So, all's not lost as is being made out to be by the Opposition and a section of economists. Take, for instance, the depreciating rupee. That's nothing new. In 2013, the rupee crashed 25 per cent between May and August. Today, it is down by 13 per cent. Finance Ministry officials are confident that the rupee should only appreciate from this low of 74.45 to a dollar. Actually, it has gained during the last few days, with 73.56 on Friday as the crude oil prices are cooling.

The latest CPI and IIP data released by the CSO on Friday present a better-than-expected picture. The CPI, at 3.77 per cent, has been constantly falling over the last four quarters. Food inflation, according to the data, stood at 1.08 per cent. In fact, there's been a deflation in certain food items, such as vegetables and pulses. That should be good news for retail consumers. Consumer industries have driven growth which could be supportive for the consumer sentiment at this time.

The stock market crash is attributed to global cues such as the biggest stock erosion seen since February, 2018. That has had a ripple effect across the globe, including India. It does impact investor sentiment. However, for now, the Indian market continues with its seesaw. After falling over 700 points on Thursday, hitting the 34,000 mark, it recovered lost ground on Friday, gaining 732 points. Similarly, Nifty moved up 237 points. Textiles, FMCG and IMFL stocks showed an impressive performance. Growth is picking up, too, and experts' outlook for the current fiscal puts it at 7.5 per cent. So, the government has a rope to work on the economy. And it has begun.

Beginning with subsidy on petrol/diesel prices of Rs 2.50 by the Centre and Rs 2.50 by some states (albeit still high), the government has begun with measures to curb on imports to address CAD worries that could otherwise spiral out of control. On Thursday, the Centre hiked import duties on 15 items, including telecom products, by up to 20 per cent. Other options, too, are being discussed, such as the issue of NRI bonds. Last week, the RBI eased rules for oil marketing companies (OMCs) — the largest consumer of foreign currency — and allowed them to raise forex under the automatic route. This should also help strengthen the rupee against the dollar.

While economists predict that rising costs and fuel price inflation propelled by sharp depreciation in currency might affect consumer spending patterns, advertising in the print and electronic media does not seem to reflect the same in equal measure. It reflects the consumers' sustained appetite for spending.

Retailers claim that all these negative reports haven't affected sales. At least, not in tier 1, 2 and 3 towns. In fact, spending on daily essential grocery is rising, led by the rising trajectory of the modern trade. And self-service fancy neighbourhood stores are fast springing up. The rural consumer market could be a cause for worry. The government's focus on rural economy might change the situation. Allocation to rural and agri spends as a percentage of the total capital outlay for the states has been rising. The government has delivered its highest YoY change in MSP since 2014. So, with rural agri-GDP on way to revival and a normal monsoon this year, rural demand may see a spike in the coming days. That should bring cheer to two-wheelers and FMCG companies that have a huge exposure to the rural markets.

The government's emphasis on farm incomes, coupled with addressing the NPA mess and promoting savings through various schemes, such as Jan Dhan, will be critical and give a fillip to economic growth.

High crude oil prices, however, may have hit plywood, paints and adhesive consumption, but even that is not clearly visible on the ground.

During the last few weeks, as we head towards the festive season of Dusehra, Divali and the winter carnival followed by Christmas, the retail consumer markets usually perk up 'feel good' sentiments. While negative reports from the stock markets and high fuel price against a weakening rupee give ammunition to the opposition parties and neo-economists to attack the government and portend a bleak consumer sentiment in the short term, its impact is likely to be somewhat contained by the revelry of the festive mood across the country.

While the Indian economy has been on recovery over the past four quarters, led by a broad-based spike in growth, it also indicates gradual mellowing of disruption caused by GST and demonetisation. The rupee will get a cushion with OMCs, now allowed to raise ECBs (external commercial borrowings), and there's a possibility of NRI bonds. Crude oil prices, too, seem to be cooling off. That should boost the rupee in the short term. North Block mandarins say that the country has a good forex reserve as compared to five years ago, and there's little worry on that front. With three crucial state elections slated for this year and General Election in 2019, the government will have to move fast with strategies to keep markets and consumers happy.