Photo for representational purpose only.

Nitin Jain

Tribune News Service

Ludhiana, October 30

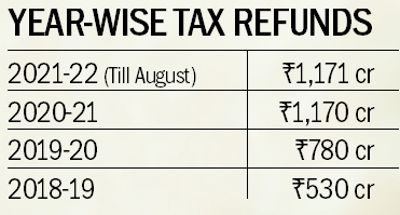

The industry has been given tax refunds amounting to Rs3,651 crore in the state during the last four years, the government has confirmed.

The refunds included reimbursement of net State Goods and Services Tax (SGST) and the Value Added Tax (VAT) to promote the trade and industry, besides attracting new investment to the border state, officials have said.

CHIEFMINISTERSPEAKS

Our endeavour is to provide maximum support and benefit to the trade and industry so that Punjab continues to attract investment in thrust sectors and emerges as the best destination for promotion of business. The government will continue to extend the existing benefits, besides considering more sops to the industry as per the requirement and possibility factors. —Charanjit Singh Channi, Chief Minister

The Chief Executive Officer (CEO) of Invest Punjab, state government’s one-stop unified regulator controlling 23 different departments to provide advanced single-window facilitation to investors, Rajat Agarwal today said the SGST refunds touched a new high of Rs1,171 crore in the current fiscal till August.

The Chief Executive Officer (CEO) of Invest Punjab, state government’s one-stop unified regulator controlling 23 different departments to provide advanced single-window facilitation to investors, Rajat Agarwal today said the SGST refunds touched a new high of Rs1,171 crore in the current fiscal till August.

In the previous years, the industry got Rs838 crore SGST refunds and Rs332 crore VAT refunds, Rs780 crore SGST refunds in 2019-20 and Rs530 crore SGST refunds in 2018-19.

Under its policy to provide fiscal incentives to the industry, including MSMEs and large units in thrust sectors, the state government has been offering investment subsidies by way of reimbursement of net SGST on intra-state sales.

Besides 100 per cent of net SGST reimbursement for 10 years with a cap of 125 per cent of fixed capital investment (FCI), the industry was also getting total exemption from electricity duty for 10 years, 100 per cent exemption/reimbursement from stamp duty on purchase or lease of land and building, total exemption from CLU/EDC and property tax for 10 years.

In addition, sector-specific special incentives for industrial units in thrust sectors were also being extended, which included reimbursement of market fee, rural development fee, other state taxes and fees on raw material for food processing industries, 100 per cent reimbursement of all taxes and fees paid for purchase of raw material for food processing units up to 10 years for all category of units, additional support to units under the M-SIPS scheme of the Centre, 50 per cent top up of Capex support provided by the Centre to units setting up in notified Electronics Manufacturing Clusters (EMCs) under the M-SIPS scheme.

Under the Central support system, the benefit was provided to the first 10 anchor units limited to a maximum of Rs10 crore per unit.

Moreover, additional support was extended to the industrial units under the Amended Technology Upgradation Funds (A-TUF) scheme of the Centre, which entails 5 per cent interest subsidy for MSMEs for new/ expansion/ diversification in addition to benefits under the A-TUF for apparel, made-ups and technical textiles for 3 years subject to a maximum of Rs10 lakh per year.

Extending capital subsidy to IT/ITES units, the government was providing 50 per cent of the FCI subject to a ceiling of Rs2.5 crore per unit.

Similarly, the tourism and hospitality industry was getting 100 per cent exemption from entertainment tax to all new investments in special theme parks, amusement parks, water parks, adventure parks, cinematic tourism like film institute, film city, film studio, theatres and mini theatres.

Join Whatsapp Channel of The Tribune for latest updates.