Sanjeev Singh Bariana

Tribune News Service

Chandigarh, July 19

The geographic information system (GIS) survey, ordered by Local Bodies Minister Navjot Singh Sidhu in all 10 municipal corporation townships of Punjab, has confirmed a huge revenue-generation potential by way of payment of property tax.

In Ludhiana, there are 4.2 lakh properties (residential, commercial, industrial and vacant plots) as per the survey. However, the number of official taxpayers is only slightly above one lakh.

“Ludhiana has around 1.2 lakh plots of up to 5 marla. These are exempt from paying tax. We were not getting our legitimate money from around 2 lakh eligible property taxpayers,” Sidhu said.

“The number of taxpayers came down from about 3 lakh in 2013-2014 to 2 lakh in 2014-2015 and a little more than 1 lakh last year,” Vivek Verma of Ludhiana MC said.

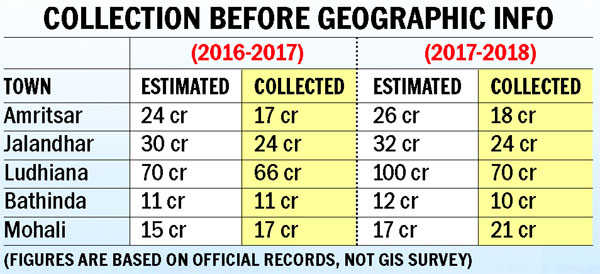

The MC collected around Rs 70 crore as property tax in the last fiscal (2017-2018).

The total property tax collections in the state stood at Rs 240 crore with corporations contributing around Rs 168 crore. Official records put the total number of buildings in the state at 27.5 lakh, of which around 50,000 are industrial and 4 lakh commercial. While the survey is still underway in most corporations, the results in Bathinda show at least 30 per cent buildings find no mention in official records. The survey, currently on in Jalandhar, shows the total number of buildings is more than 2 lakh, but property tax has been received in respect of only about 69,000.

An official of the Jalandhar MC said: “We have got a list of at least 96 illegal colonies where no one is paying tax.”

Inderjit Singh, Superintendent, Pathankot MC, said: “As per our records, there are about 57,000 properties in the town and we are getting tax in respect of 25,000. The process of upgrading our list is on.”

An MC Superintendent said, “Tax revenue has dipped significantly since 2013 after the government decided to do away with house tax. The rates of the revised property tax are much lower. The second big problem is the lack of staff. We send notices to defaulters and seal properties. We need more manpower to enhance collection and recovery.”

The government reduced house tax rates in June 2013 and gave taxpayers the right to self-assess their properties. Out of Rs 174 crore dues on April 1, 2017, the government could recover only Rs 11 crore till March 31 this year.

Sidhu said: “I have asked MCs for a continuous update on tax collection along with reasons for non-receipt.”