Immediate trigger: In the wake of the trouble that the PMC Bank got into last year, it has been decided that all urban and multi-state cooperative banks will be brought under the RBI’s direct supervision. Will it be able to take on this additional burden?

Senior Economic Analyst

The decision to bring all urban and multi-state cooperative banks — effectively the big ones — under the direct supervision of the Reserve Bank of India (RBI) should have been taken long ago. Its aim is to secure the interests of depositors who currently number 86 million and have a massive Rs 4.8 lakh crore — 2.5 per cent of GDP — of their money in these banks.

The cooperative movement in India, under which these banks have come up, dates back to the early twentieth century. It was meant to offer both short-and long-term credit — mostly in rural areas — to those at the bottom of the pyramid. As these are cooperatives, they are owners and also the customers. The fact that moneylenders still abound, both in rural areas and urban slums, indicates that the cooperative movement has not delivered all that it was expected to.

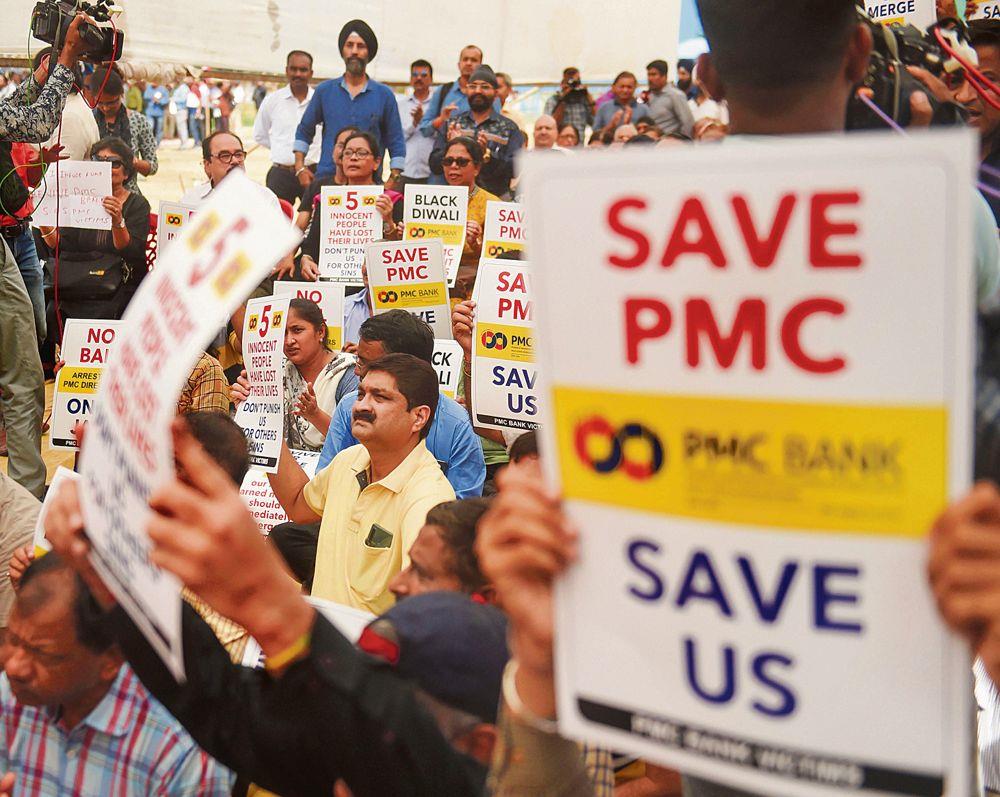

The immediate trigger is the trouble that the Punjab and Maharashtra Cooperative Bank (PMC) got into last year which led to its board being superseded and a moratorium on withdrawals imposed. The depositing public has had to live with the periodic high-profile failure of the cooperative banks that goes back three decades. Harshad Mehta and Hiten Dalal sank the Mumbai-based Mercantile Cooperative Bank in 1991 and Ketan Parekh did the same with the Ahmedabad-based Madhavpura Cooperative Bank in 2001. In the PMC Bank, over 70 per cent of the loans went to a single borrower, HDIL, which defaulted.

The government’s action puts these cooperative banks on a par with the scheduled commercial banks, that is regular banks whose branches you see everywhere. The main problem with ensuring that cooperative banks of any size were run in a responsible manner was that they till now came under dual control: the Registrar of Cooperative Societies in the states and the Centre and the RBI.

While the RBI’s remit was to ensure that the banking operations were conducted in a sound manner, the Registrar of Cooperative Societies oversaw the process by which members of the cooperative institutions, in these cases the banks, selected the directors who ran the bank and also supervised its audit.

Few members of large cooperative banks come to vote at annual general meetings and these banks have come to be run by small groups, who in turn, have obliged a few powerful borrowers. This compromised the quality of governance in such banks. And when one of these powerful large borrowers got into trouble, they defaulted at the cooperative bank and jeopardised its future, putting a question mark over the fate of deposits at the bank.

The cooperative credit societies came into being when a small and homogeneous group of people got to pool their savings and lend among themselves. But the self-help and cooperative nature of the whole exercise declined when organisations became big and impersonal.

Today, the whole idea of cooperation has passed its time. Over the years, new institutional structures have come up in the space that was originally set aside for the cooperatives. Now, there is an entire hierarchy of institutions that take care of the small savings of small people. Right at the bottom are the self-help groups, often linked to banks, which muster their members’ savings and create the ability for them to borrow.

Alongside, there is the pyramid of microfinance institutions (MFI) which are in the same business of lending to those at the bottom of the pyramid. Over time, the biggest ones among them have come under the supervision of the RBI by registering as non-banking financial companies (NBFCs) and the most solid among them have been allowed to become small finance banks. And right at the apex is the Bandhan Bank, a former MFI which is now a full-fledged scheduled commercial bank.

The whole idea of a cooperation — a group pooling its resources to accommodate members — has declined and the individual is seen as an economic agent in a market-driven neo-liberal setup. Given the way the world has moved, large cooperative banks have been given by the RBI the option to turn themselves into small finance banks, but they have shown little interest.

Over the decades, the RBI has mooted several innovations for large cooperative banks. The most distinctive is the creation of an additional layer— a board of management of fit and proper persons, other than the board of directors, in actual control of operations. But this has not happened and crises still take place.

Ending the duality of the past and putting large cooperative banks fully under the supervision of the RBI is an improvement on the past, but the question is whether the RBI has the time or the human resources to take on this additional burden of overseeing a large number of institutions spread across the country.

In the case of scheduled commercial banks, the RBI has been faulted for stepping in too late, as with Yes Bank. The RBI has been found not to have had its ear to the ground sufficiently when it comes to the operatives in the country’s main financial centres so that it can spot dark clouds before they are fully visible to all. Now, it will have to be tuned into the financial space across the country since as many as 1,540 cooperative banks will come under its supervision — in contrast, there are 32 scheduled commercial banks, with 12 belonging to the public sector. That is a tall order!

Join Whatsapp Channel of The Tribune for latest updates.