Friday, September 24, 1999

today's calendar

|

B U S I N E S S | Friday, September 24, 1999 |

| weather today's calendar |

| Maruti trails in sales NEW DELHI, Sept 23 — The car segment clocked an astounding 70 per cent growth in sales in August compared to last year mainly on the strength of small cars such as Telco’s Indica and Fiat’s Uno but the market leader Maruti failed to keep pace with the industry growth during the month. |

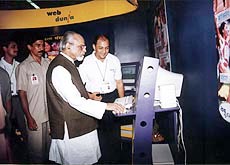

New Delhi: former Prime Minister I.K. Gujral inaugurating the first Hindi postal "webdunia.com" at Pragati Maidan in New Delhi on Thursday — PTI |

New excise audit from November Sharif

faces hard call on economy Punjab

tax anomaly to go Dunlop

refused time for revival |

|||||||

Maruti trails in sales NEW DELHI, Sept 23 (PTI) — The car segment clocked an astounding 70 per cent growth in sales in August compared to last year mainly on the strength of small cars such as Telco’s Indica and Fiat’s Uno but the market leader Maruti failed to keep pace with the industry growth during the month. Against the car industry growth of 70 per cent, Maruti registered a 31 per cent growth in sales to 37,840 units in August while Indian subsidiary of the world’s largest car maker General Motors saw a 23.7 per cent decline in sales during the same period. There were clear indications of revival in the Indian autosector. During August, a 5.1 per cent and 30.8 per cent growth in sales recorded by the scooters and motorcycles segments respectively resulted in a 14 per cent growth by the entire two-wheeler segment, according to the data compiled by the Society of Indian Automobiles Manufacturers (SIAM). Maruti Udyog posted a 15 per cent growth in domestic sales to 164,375 units in the April-August ‘99 period from 139,270 in the same period last fiscal. Telco sold 16,685 cars in the period. Ind Auto registered a 150 per cent growth to 8,466 units in the first five months of 1999-2000 mainly because of its Uno model. Car sales of Hyundai and Daewoo were 24,635 and 11,502 units respectively during the period. The mid-size car segment

disappointed as Ford, General Motors and Honda Siel

recorded a negative growth during April-August this year.

|

New excise audit from

November NEW DELHI, Sept 23 — A new excise audit programme and manual would be applicable from November in 60 commissionerates, Director General of Central Excise (Anti-evasion), Mr R.K. Chakrabarti said here today. Addressing a meeting of the Assocham here, Mr Chakrabarty said that the programme and manual sought to improve the system of excise auditing and make the department more professional and assessee friendly. The programme is being developed with the help of a Canadian aid agency. All reforms proposed under Central Excise and Customs Rule and Regulations are likely to be ready for implementation by June 2000 and Price Waterhouse Coopers, Canada, is monitoring them. The two that are ready for launch involve self-assessment by corporates and an audit manual. Forty assesses participated in the test audits on the basis of two drafts manual last year. When implemented, they are expected to improve collections, help settle disputes and even enable payments during audit, Mr Chakrabarti said. The Central Board of Excise and Customs (CBEC) is also considering setting up a full fledged Audit Board headed by DG (Audit) to sustain the new systems. Until then, an audit board is being created at 25 commissionerates under the chief commissioners. Allaying corporates’ fears about the new procedures and systems, Mr Chakrabarti said these projects would be driven by trained officers and would be professional. A core group of 15 was working on changing management and assessee attitude towards the new protocols. The department was in no hurry to implement them unless the officers were fully trained. The CBEC is also working on audit selection which will focus on sectors and assessees which were “high risk” cases for revenue collection. Among the projects in

different stages of readiness are the creation of a

comprehensive excise and customs database, simplification

of returns and preparing a document for service tax

audit. The CBES has approved the database plan, which

will become operational early next year. |

Sharif faces hard call on

economy KARACHI, Sept 23 — Halfway through a five-year term, Pakistan Prime Minister Nawaz Sharif faces a dilemma — to appease voters with job and wealth-creation schemes or satisfy international donors through tight economic management. “He (Mr Sharif) is in trouble. The deepening economic crisis will eventually translate into anger and frustration and the Opposition is trying to cash in on it,’’ said a financial analyst who asked not to be identified. When he assumed power with a massive mandate in the February 1997 poll, Mr Sharif’s campaign pledge was to bring an end to years of economic stagnation, and his background with the wealthy Ittefaq family steel business raised expectations. Two-and-a-half years later his critics are baying at the door and accuse him of doing only what he promised not to do — appease India. “Sharif out’’ A July 4 order by Mr Sharif that Mujahideen (holy warrior) militants withdraw from India’s Kargil heights to avoid a fourth Indo-Pakistani war has rallied 19 opposition parties under a single “Sharif out’’ banner, and they are waving it vigorously. The Pakistani government even had to recently play down a surprise US statement of concern about a possible military coup because of political turmoil and demands that Mr Sharif quit. The government says its May 1998 nuclear tests and the military showdown with India over Kargil were among “the finest hours in the history of Pakistan’’. But the two events have not improved the country’s image among foreign investors, who took flight when the Government decided to rewrite contracts signed by the previous Benazir Bhutto Government with independent power producers (IPPs). The tests triggered US-led sanctions, some of which are still in place, and an image abroad of an unstable country. Only a comprehensive rescheduling of its $ 32 billion debt this year prevented the country from default. Financial analysts said Mr Sharif had some sympathy for having to be seen to face up to India and its nuclear tests, but the economic price has been high and painful. “Undoubtedly, the severity of all these decisions is unquestionable, but 135 million people and a fragile economy have paid a high price for most of these measures,’’ said Mr Mohammad Sohail, research head at brokers I.P. Securities. Mr Sohail said average gross domestic product growth in the past two years had been 3.7 per cent, against an average of over five per cent in the previous 5 years, while total foreign investment had declined by 57 per cent in the last two years. The tests were followed by a freeze on foreign currency accounts and several other unpopular measures to counter the sanctions until they were partially lifted in December, resulting in a resumption of stalled lending and the debt rescheduling. Stiff price But donor help is subject to strict adherence to an international monetary fund (IMF) structural reform agenda, mostly consisting of unpopular measures to expand the tax base, document the economy and cut back Government spending. A recent showdown with traders opposing an IMF-demanded general sales tax on utilities and retail sales cast serious doubts on Mr Sharif’s ability to implement the IMF reform agenda. Traders simply refused

to pay the tax and, for the second time since he came to

power, Mr Sharif excluded them from it. — Reuters |

Trade sanctions boomerang on US farmers WASHINGTON, Sept 23 (AP) — Trade sanctions imposed on India and Pakistan after they tested nuclear devices are causing US exporters look unreliable, according to a government report. The sanctions were triggered in May 1998 after both countries conducted underground nuclear tests in violation of international agreements. While the sanctions have had little impact on either country or US exports, the brunt of what lost sales did occur fell on American farmers, says the US International Trade Commission. The commission has studied the impact of the sanctions at the request of the House Ways and Means Committee. Its report was released today by the lawmakers. “This is more proof that unilateral sanctions aimed at other countries often have a boomerang effect on US workers and our economy,” said Rep. Phil Crane, a Republican from Illinois. “In this case it was the farm belt, but who knows what US industry will be next?” he asked. A copy of the report was obtained by AP. The study is being released at the same time House and Senate negotiators are debating legislation that would allow the sale of food and medicine to Cuba for the first time in four decades and make it harder for a President to impose future embargoes. President Bill Clinton

has temporarily waived restrictions for India and

Pakistan on the use of various federal aid, including

credits and guarantees for the sale of agricultural

products. |

Punjab tax anomaly to go CHANDIGARH, Sept 23 — Due to the imposition of first point sales tax on several items used as raw material the industry in Punjab has to face double taxation when such goods are sold within the State. However, soon this anomaly will be sorted out and the raw materials used by manufacturing sector will be tax free irrespective of its point of origin. This was stated by Mr CL Bains, Financial Commissioner & Principal Secretary, Punjab, during an interaction organised by the CII here yesterday. Mr Bains said at present the sales tax collection in Punjab is around Rs 1,500 crore in which the contribution of industry and trade is Rs 750 crore. The rest comes from the sale of agricultural commodities, petroleum products and IMFL. He assured the industry that issues like delinking of installed capacity and its substitution with average production of the last three years for vanaspati manufacturers, bringing PGST and exemption rule 1991 in tune with industrial policy of 1996 for the industries that have gone for expansion and modernisation, providing clarification on the definition of edible oil, ensuring supply of adequate “C” forms and allowing set-off under Rule 30 to exporters for the first point taxable goods will be looked into and necessary steps or notification will follow at the earliest. Earlier, Mr K L Khurana,

Chairman, CII Punjab State Council urged the Punjab

Government to speed up the computerisation of the Sales

Tax Department and use IT tools to make both the

collection and payment of sales tax a less cumbersome

exercise. |

Dunlop refused time for revival NEW DELHI: The BIFR has refused to grant more time to Dunlop India Ltd to make its networth positive on its own and asked IDBI to formulate a revival package. A two-member BIFR Bench, including Chairman PP Chauhan, said there was no justification in allowing Dunlop any further time as the company had “not gainfully utilised” the time available to it. Siemens gets 65 cr order NEW DELHI: Siemens has won a Rs 65 crore contract to supply GSM infrastructure and services to Emtel of Mauritius. The GSM equipment will be sourced from Siemens AG and Siemens Public Communication Network Ltd, India will provide the services including RF planning, network plan, project management, installation and commissioning, integration, technical support, training and O and M support. RIL plant commissioned AHMEDABAD: Reliance Industries Limited has commissioned the first line of its Paraxylene plant at its Jamnagar Petrochemicals Complex in Gujarat ahead of schedule. Godrej restructuring MUMBAI: The Godrej group today announced the transfer of a part of Godrej Soaps Ltd’s (GSL) holding in its joint venture Godrej Sara Lee Ltd (GSLL) to holding company Godrej & Boyce Mfg Co Ltd (G&B). |

| H |

| | Nation

| Punjab | Haryana | Himachal Pradesh | Jammu & Kashmir | | Chandigarh | Editorial | Sport | | Mailbag | Spotlight | World | 50 years of Independence | Weather | | Search | Subscribe | Archive | Suggestion | Home | E-mail | |