|

|

|

|

|

Tax planning tips for FYí14

3 reasons to exit your mutual fund

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

tax advice

|

|

Tax planning tips for FYí14

I recently got a call from one of my friends who wanted to invest in an investment avenue which is eligible for tax deduction u/s 80C. He told me itís urgent as he needs to submit the proof of investment to his employer before January 31, 2014.

Here are some tips for tax planning if you are looking for a tax-saving instrument So do not wait till end and plan well in advance. Younger investors should invest more in ELSS scheme of mutual fund where as senior people can opt for PPF deposit or

NSCs. The combination of PPF and ELSS scheme is a good option to go with, if you do not have access to professional advice. The author is Head, Financial Planning, Apna

Paisa. The views expressed in this article are his own |

||

|

3 reasons to exit your mutual fund

It is never a good idea to fall in love with your investment ó they should be redeemed if circumstances demand so. At the same time selling your mutual fund because you want to buy the latest smartphone is not exactly prudent financial planning. When should you exit your mutual fund?

Here is a checklist to help you take a decision: When your financial goal is due Since investments are typically made for meeting a financial goal such as buying a house or a car or for childís education or marriage, it follows that you redeem the mutual fund investment once the goal is in sight. Financial discipline is all about being invested till the time you donít near your goal. Usually, this would be the most common reason for investors to redeem their investments. When the fund is not what it used to be You bought the mutual fund for a reason ó mainly because it was a good fit for your financial goal. If it continues to remain that way, then you donít need to exit the investment. However, if there is a fundamental change in the nature of the scheme, which compromises its ability to meet your goals, you must consider exiting the investment. Some of the fundamental changes include takeover by another mutual fund which does not have the requisite track record or change in the fundís risk profile meaning it is making riskier investments like increased allocations to mid caps which is not what you bargained for or a merger with another fund within the same fund house although with a different investment objective. These are but some scenarios that call for a re-evaluation. Your financial planner is best placed to guide you. When your portfolio needs

re-balancing Since equity and debt markets are in a state of flux it is unlikely that your portfolio will retain its original allocation. Letís say you have a 60:40 equity-debt portfolio as recommended by your financial planner. Over a short period of time, equity markets rally 20% and for the sake of simplicity letís assume this reflects exactly in the equity portion of your portfolio. The debt portion on the other hand is more or less constant. So the portfolio has moved from 60:40 equity-debts to 72:38, which is clearly out of line vis-ŗ-vis your initial allocation and perhaps even your risk profile. If this distortion persists, it calls for re-balancing ó meaning you may have to consider redeeming some mutual funds ó either completely or in a staggered manner ódepending on which fund has grown more or faster than others. The objective is to revert to your original allocation. While these are the primary reasons for redemption, there can be other triggers like a misjudgment in fund selection for instance. At all times, consult your financial planner to ensure you are invested in the right fund and in the desired allocation. The author is senior vice-president and business head, Edelweiss Financial Planning. The views expressed in this article are his own |

||

|

NRI can give a loan to HUF

SC Vasudeva My queries are:

I am an employee of the Government of Andhra Pradesh. I have been receiving nearly Rs 10,000-15,000 per month regularly from my younger brother from the USA from his salary (tax paid) who is working in an American company. I have got a permission to accept the amount from him by the departmental authorities. Please clarify whether I have to pay tax on this amount? Are there any suggestions in this regard? ó Raghav On the basis of facts in the query, no tax would be payable on the amount so received by you from your brother as the amount remitted by your brother from America is not your income but is in the nature of a gift from him. I hope your brother has been sending a letter with regard to such a gift. If not, you may obtain such letter(s) for the purpose of your record as well as for tax assessments. |

||

|

||

|

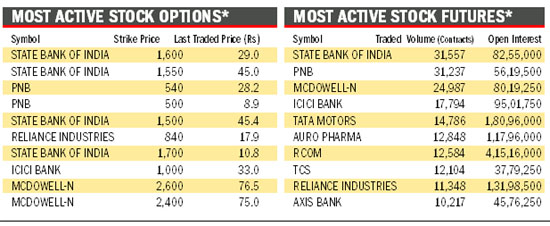

What are Options & Futures* An option gives you the right to buy or sell the underlying asset . A call option gives you right to buy the underlying asset while a put option gives you the right to sell. An option contract specifies the strike price, that is, the price at which you can buy or sell the underlying asset. In Futures, you buy a contract which will have a specific lot size of shares. When you buy a Futures contract, you donít pay the entire value of the contract but just the margin. Open interest is the the total number of contracts not closed or delivered on a particular day. |

||

|

| HOME PAGE | |

Punjab | Haryana | Jammu & Kashmir |

Himachal Pradesh | Regional Briefs |

Nation | Opinions | | Business | Sports | World | Letters | Chandigarh | Ludhiana | Delhi | | Calendar | Weather | Archive | Subscribe | E-mail | |