Traders want GST rate to be 5 per cent on dry fruits, meet Finance Minister

Neeraj Bagga

Tribune News Service

Amritsar, June 14

The clamour to keep indigenously manufactured products like shawl, Punjabi jutti out of the GST grows.

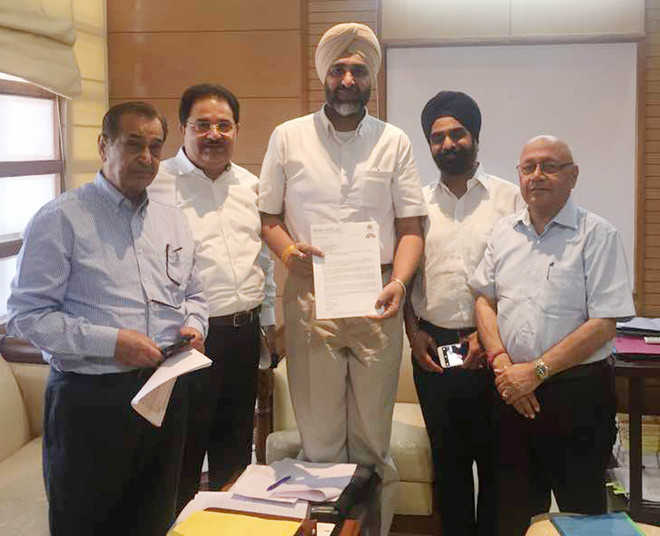

A delegation of local traders and industrialists led by Congress MLA OP Soni met Finance Minister Manpreet Singh Badal. The delegation wants the GST rate to be 5 per cent from 12 per cent on dry fruits.

It apprised the Finance Minister of their demands.

BK Bajaj, president, Indo Foreign Chamber of Commerce, who was a part of the delegation, said the increasing taxes on dry fruits would make them out of reach of the middle and lower class.

Another member of the delegation Tarlok Singh said Punjabi Juttis that were being made here had witnessed a change. These were also struggling to survive in the cyber age, he added.

The trade was facing several problems and it must be exempted from the tax net to help it in flourishing, he added.

City’s Mochi Market, which has been shifted to Bhagat Ravi Dass Market near Darbar Sahib market, is the home of variety of juttis. Over the years, its artisans have gained expertise.

PL Seth, president, Shawl Club of India, said, “Shawls were manufactured in a bulk in Amritsar and Ludhiana only. Traditionally shawl is being manufactured in the holy city for the past many decades. More than 47 new units of shawl manufacturing with 400 shuttles less rapier looms with electronic jacquards have come up between 2002 and 2013. These are also enhancing their capacities. Most of these are Woolmark Licensees.”

He said most of the raw material used in the industry comes from outside the state and manufactured products are sold in the country and exported to various foreign nations.