Vijay C Roy

Tribune News Service

Chandigarh, March 6

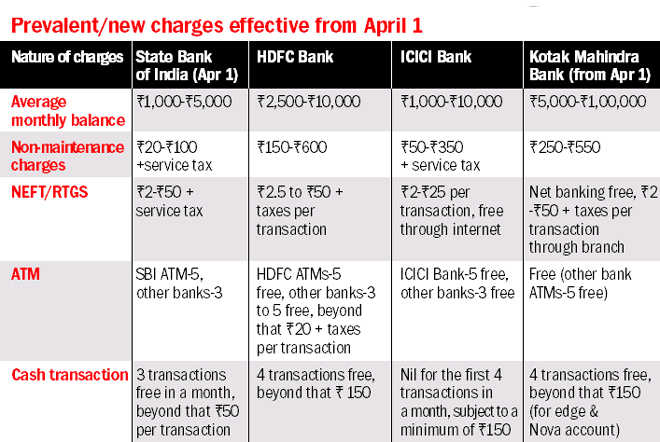

Come April 1, customers of public sector and private sector banks will have to pay more towards bank charges and fees. Some of the banks, including SBI and Kotak Mahindra Bank, have already announced the revised charges, effective from April 1. Other banks are also expected to follow the suit soon.

Private sector banks such as HDFC Bank, ICICI Bank and Axis Bank have increased charges for cash transactions from March 1.

In case of other banks, which are yet to announce the increase in charges, sources in the banking industry said the number of free ATM withdrawals may be slashed. There will be a hike in charges levied in the coming months in a move to discourage people from using cash. The proposed move will hurt the common customers since cash is still a mainstream medium for transactions.

Experts criticised the move and said the government was making a case for digital economy at a time when the country’s mainstream digital infrastructure was not fully equipped.

Country’s largest bank SBI has decided to impose a fine of Rs 50 plus service tax on every cash transaction beyond three from April 1. As per the revised charges of SBI, failure to maintain Monthly Average Balance (MAB) in accounts will attract a penalty of up to Rs 100 plus service tax depending upon the area such as rural, semi-urban and metropolitan. The charges and MAB vary according to the location of bank, with minimum charges in case of rural branches.

Also, cash withdrawals from ATMs will attract a charge of up to Rs 20 beyond three transactions and Rs 10 for more than five withdrawals from SBI ATMs.

Since all five associates of SBI, namely State Bank of Bikaner and Jaipur, State Bank of Mysore, State Bank of Travancore, State Bank of Patiala and State Bank of Hyderabad, are likely to be merged with SBI from April 1, the charges will be applicable to other banks also.

In case of Kotak Mahindra Bank, failure to maintain average minimum balance will attract a penalty starting from Rs 350 to Rs 550 for different types of accounts. The bank will offer free four transactions at branch and beyond that a minimum charge of Rs 150 will be levied. The bank will also charge Rs 30 quarterly for daily SMS and Rs 30 per quarter for weekly SMS service.

HDFC Bank, ICICI Bank and Axis Bank, have already started imposing (from March 1) a minimum charge of Rs 150 per transaction for cash deposits and withdrawals at bank branches beyond four free transactions in a month. These charges are applicable to savings as well as salary accounts.

Unlock Exclusive Insights with The Tribune Premium

Take your experience further with Premium access.

Thought-provoking Opinions, Expert Analysis, In-depth Insights and other Member Only Benefits

Already a Member? Sign In Now