Vijay C Roy

Tribune News Service

Chandigarh, December 15

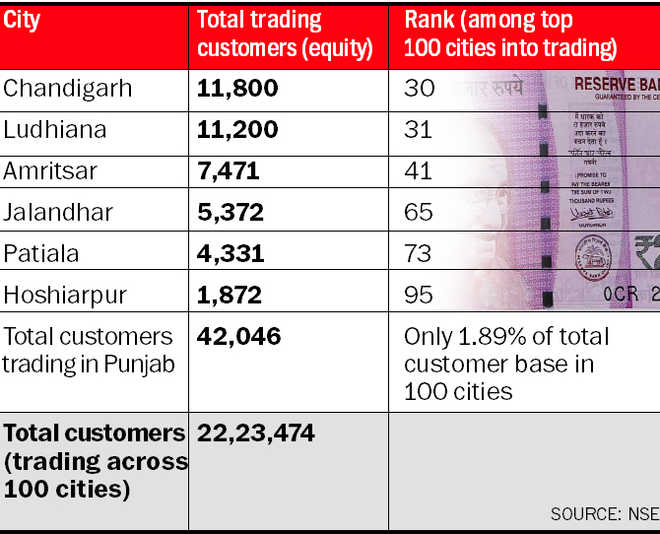

Punjab, a lucrative market for fast-moving consumer goods, automobiles and white goods etc., seems to be laggard when it comes to investment in equity. According to data of the National Stock Exchange (NSE), Punjab, including Chandigarh, represents only 1.89% of total customer base of 100 cities. The data suggests people prefer conservative mode of investments such as real estate, gold and fixed deposits to equity market.

However, officials dealing in equities are of the view with reduced interest rates on FDs and realty sector not doing well, they see incremental money flow into the equity markets if the investors are educated.

As on September 2017, the number of investors across top 100 cities in the country that were into trading (equities) were 22,23,474. As far as Punjab is concerned, the number of investors was 42,046 spread across six cities, including Chandigarh.

As per the data, in Punjab Ludhiana leads the pack with 11,200 trading customers followed by Amritsar (7,471), Jalandhar (5,372), Patiala (4,331) and Hoshiarpur (1,872).

Among the top 100 cities, Chandigarh has been ranked at 30 (11,800 trading customers) followed by Ludhiana (31) and Amritsar (41). Jalandhar, Patiala and Hoshiarpur have been ranked 65, 73 and 95, respectively.

Dhiraj Relli, MD & CEO, HDFC Securities, said, “The numbers are not encouraging and it may be due to low awareness. This is a compelling reason why Punjab should take equity investing seriously since it is the only asset class that has given 16.4% tax- free return.

The per capita GDP of Punjab for FY 2016-17 was Rs 1,51,634 and it ranked 16 among the states and UTs. “While this isn’t high, the fact that equity penetration is low makes it quite an interesting state to explore as the potential is high,” he said.

According to brokers, especially in Ludhiana, where broking houses have various corporate and institutional clients, a considerable number of people settled abroad remit money to their families on a monthly basis and a good portion of this money is used to invest in property, gold and fixed deposits where returns are almost stagnant now. They said investment in equity will provide a good opportunity to create wealth.

Unlock Exclusive Insights with The Tribune Premium

Take your experience further with Premium access.

Thought-provoking Opinions, Expert Analysis, In-depth Insights and other Member Only Benefits

Already a Member? Sign In Now