SEBI’s order spooks markets

Sanjeev Sharma

Tribune News Service

New Delhi, August 8

The stock markets were rattled today and investors confused as the markets regulator SEBI in a sudden order put trading curbs on 331 suspected shell companies identified by the Ministry of Corporate Affairs and directed the stock exchanges that these scrips will be moved to a category where trading is permitted only once in a month and audits will be carried out by bourses to ascertain the credibility of these companies.

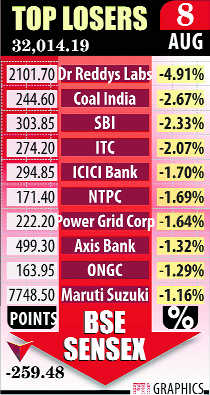

As trading curbs were immediately enforced by the stock exchanges from today in these 331 stocks, the move hurt market sentiment and the BSE Sensex ended down by 260 points. A few companies in the list which are operational and have a large investor base protested with SEBI and said the order where no prior notice was issued has tarnished their reputation and harmed their investors.

The move is seen as part of the government crackdown on shell companies which are not operational and are used for money laundering. As part of the drive, the Ministry of Corporate Affairs has removed 1.62 lakh companies from the Register of Companies.

The government had also requested the RBI to freeze accounts of the defaulting companies who have long exceeded the stipulated time limit, for filing of financial statements and returns, under the Companies Act. The government has also asked the RBI to circulate the details of defaulting companies to all the banks with the advice to exercise enhanced due diligence while dealing with these companies.

The SEBI order issued by its surveillance department late on Monday said trading in all such listed securities shall be placed in Stage VI of the Graded Surveillance Measure (GSM) with immediate effect. Under the stage VI of GSM framework, trading in these identified securities shall be permitted only once a month under trade to trade category.

“Therefore, as per the provisions of GSM framework, the securities shall not be available for trading from tomorrow. Trading in these securities shall be permitted once a month (First Monday of the month)”, the SEBI order said.

In addition, stock exchanges will verify the credentials and fundamentals of such companies through an independent auditor and if necessary, even conduct forensic audit of these companies.

“On verification, if Exchanges do not find appropriate credentials/fundamentals about existence of the company, exchanges shall initiate the proceeding for compulsory delisting against the company”, the order said.

The shares held by the promoters and directors in such listed companies shall be allowed to be transferred by depositories only upon verification by exchanges concerned.

Real estate developer, Parsvnath Developers which has been named in the list has written to SEBI protesting that its name and reputation has been tarnished and it is not a shell company. It said the “directions given by SEBI are uncalled for and without any basis”.

J Kumar Infraprojects issued a statement saying it is not a shell company and the suspicion of the regulator is uncalled for. It said it has paid income tax to the tune of Rs 120 crore in the past three years and many of its infrastructure clients are government agencies.

Experts said the sudden SEBI move is surprising and it has caused erosion of wealth. Rajesh Narain Gupta, Managing Partner, SNG & Partners said SEBI order has taken industry and investors by surprise. “This has lead to erosion of serious wealth and if some of the companies are found to be not shell companies this order shall still be a death knell on their perception and valuation,” he added.

Trading permitted only once a month

- Markets regulator directed the stock exchanges that scrips of these companies will be moved to a category where trading is permitted only once in a month and audits will be carried out by bourses to ascertain the credibility of these companies

- As trading curbs were immediately enforced by the stock exchanges from today in these 331 stocks, the move hurt market sentiment and the BSE Sensex ended down by 260 points

- The move is seen as part of the government crackdown on shell companies which are not operational and are used for money laundering.