Mumbai, September 15

Fall in Chinese markets and dread about US Federal Reserve’s hike in rates pulled down Indian bourses on Tuesday. BSE’s Sensex lost0.58 per cent as investors steered clear of firmer bets.

Shanghai’ index fell below the crucial 3,000-mark. This comes a day after easing inflation boosted profit booking.

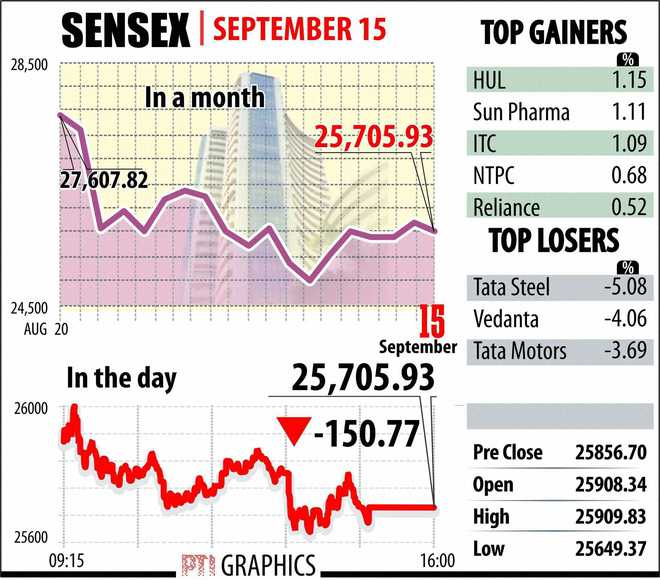

The 30-share BSE index shuttled between 25,909.83 and 25,649.37 throughout Tuesday to finally close at 25,705.93, down 150.77 points. The gauge had gained 246.49 points at the end of Monday’s session.

The NSE Nifty also went down 43.15 points or 0.55 per cent to end at 7,829.10. Intra-day, it cracked the 7,800-mark to touch a low of 7,799.75 and a high of 7,880.00.

Tata Steel suffered the most among Sensex constituents by falling 5.08 per cent, followed by Vedanta (4.06 per cent).

Metal, capital goods, consumer durable, auto and banking shares came under heavy selling pressure.

Out of 30-share Sensex pack, 23 scrips ended lower.

Major losers were Tata Steel (5.08 pc), Vedanta (4.06 pc), Tata Motors (3.69 pc), Hindalco (3.05 pc), Larsen (2.92 pc), Axis Bank (2.67 pc), M&M (1.80 pc), Hero MotoCorp (1.62 pc) and ICICI Bank (1.12 pc), while HUL rose 1.1 per cent, followed by Sun Pharma and ITC.

Among BSE sectoral indices, metal fell by 2.34 per cent followed by capital goods 2.11 per cent, auto 1.66 per cent, consumer durables 1.55 per cent and bankex 0.97 per cent.

The market breadth turned negative as 1,521 stocks closed in red while 1,100 stocks finished in green and 103 ruled steady. The total turnover rose to around Rs 2,241 crore from Monday’s Rs 1,979.79 crore.

"Participants ignored the CPI inflation data announced post market," Jayant Manglik, President of Retail Distribution at Religare Securities, said, attributing the fall to mixed global cues and lack of conviction among participants ahead of the US Federal Reserve’s two-day policy meeting.

The meeting will begin on Wednesday.

Government data that came out on Thursday showed retail inflation fell below 3.66 per cent in August. Even WPI inflation eased further to (-) 4.95 per cent in August.

The data raised hopes that the Reserve Bank of India would cut interest rates for the fourth time this year at its policy review due on September 29.

Asian and European bourses ended weaker than their previous, also weighed down by uncertainty over Wednesdays’ US Fed’s meet.

Key indices China, Hong Kong, Singapore and Taiwan fell between 0.49 per cent to 3.52 per cent, while Japan and South Korea moved up by 0.32 per cent to 0.34 per cent.

Key European indices in France, Germany and UK moved down by 0.14 per cent to 0.65 per cent.

Pramit Brahmbhatt Veracity Group CEO said: "Investors preferred to book profit at higher levels as they doubted the further upside movement. At the same time they are waiting for the release of US Fed rate decision due for the week, which will show the road ahead." — PTI

Unlock Exclusive Insights with The Tribune Premium

Take your experience further with Premium access.

Thought-provoking Opinions, Expert Analysis, In-depth Insights and other Member Only Benefits

Already a Member? Sign In Now