Chandigarh notifies new transfer policy for society flats

Ramkrishan Upadhyay

Tribune News Service

Chandigarh, November 14

A completion certificate is no more a precondition for the execution of a conveyance deed as the Chandigarh Administration has notified the new transfer policy for cooperative society flats, paving the way for resuming the transfer of flats, which had been stopped over a year ago.

Sources said the new policy, “Chandigarh scheme for transfer of flats in cooperative house building societies-2018”, had been notified with an aim to simplify the procedure while announcing a one-time relief up to June 30, 2019. Under the policy, the Chandigarh Housing Board (CHB) shall execute the conveyance deed or lease deed in favour of the society on payment of the prescribed stamp duty on the actual amount paid to the CHB.

In case where the conveyance deed or the lease deed is not executed till June 30, 2019, the said deed will be executed and registered at the prevailing market rates and not on the actual amount paid to the CHB. The completion certificate will not be a precondition for the execution of the conveyance deed. However, the president of the society concerned will give an undertaking that all basic amenities, including the firefighting equipment, are in place. At the time of registration of the sub-conveyance deed or sub-deed in the name of the original allottees, the stamp duty will be charged at the present value of the flats based on the current collector rates. Devinder Gupta, former Chairman, Housefed, said the policy required more clarity.

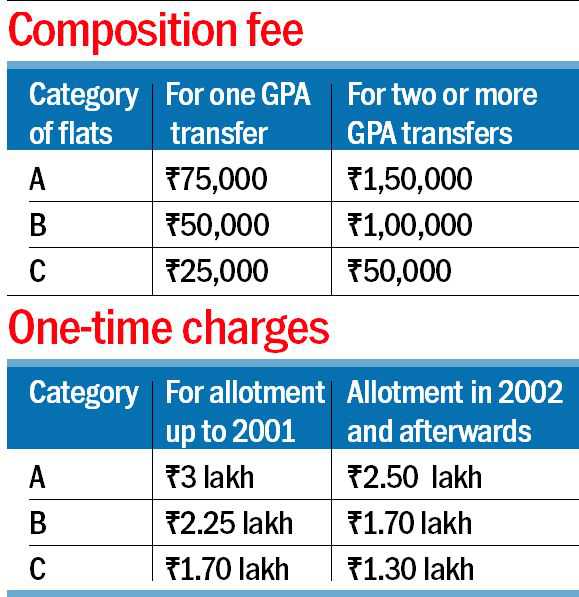

GPA holders to pay more for transfer

The transfer of society flats will cost GPA holders more as the Administration has decided to impose one-time charges on account of “unearned increase”, besides a lumpsum composition fee for the transfer of flats sold on the basis of the GPA/SA/will. It has been stated in the policy that there are many flats which have been transferred on the basis of the GPA/SA/will without execution of the conveyance deed as a result of which the stamp duty for such conveyance/transaction could not be taken. Now, it may not be possible to register the conveyance deed on previous transaction dates. Hence, it has been decided to impose a lumpsum composition fee to be recovered from the present occupants before the execution of the conveyance deed. Apart from the composition fee, one-time charges on account of “unearned increase” will also be taken. Satish Chandra Sharma and Kamal Gupta, who live in society flats, termed the “unearned increase” and composition fee unjustified.