44 FIRs filed in 10 Haryana districts for GST scam

Sushil Manav

Tribune News Service

Chandigarh, January 5

Suman Devi (40), who ekes out a living by mopping floors in Gurugram, may not have imagined in the wildest of dreams that a firm running in her name did business of Rs 426 crore in just two months to dupe the government of over Rs 40-crore GST.

She had just signed some papers brought by acquaintances Naveen and Praveen who told her she would get government scheme benefits.

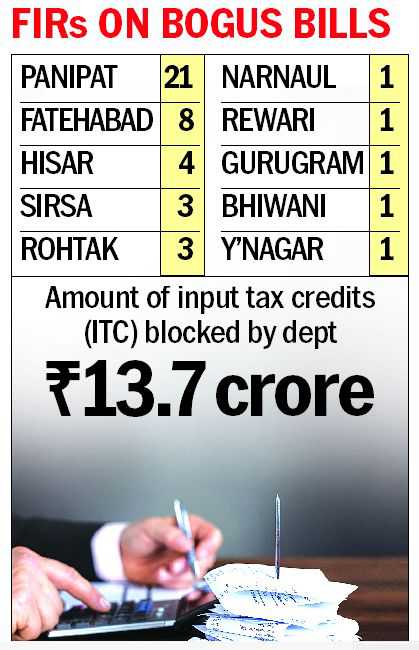

Now, her name will figure in the 44-odd first information reports (FIRs) lodged by the Excise and Taxation Department in 10 districts of Haryana today against non-existent firms, which are alleged to have hoodwinked the government of Rs 174.50 crore through input tax credits by issuing bogus invoices of Rs 1,472.48 crore.

Like Suman, Poonam of Nimoth village in Rewari, Preeti of Rohtak and Vaishali of Narnaul are among several unsuspecting women who will face criminal cases for cheating and forgery.

Sanjeev Kaushal, Additional Chief Secretary, Excise and Taxation, said orders have been issued to Deputy Excise and Taxation Commissioners (DETCs) of Rohtak, Mahendergarh, Rewari, Sirsa, Fatehabad, Hisar, Bhiwani, Gurugram (East), Yamunanagar and Panipat to lodge FIRs against 44 fake firms.

The Additional ETC (Enforcement) has told them to mention names of the accused, mobile numbers, addresses, modus operandi of evasion of tax, details of bills and invoices, copies of returns and other information relevant to the FIRs.

Kaushal said Anupam Singla, son of Krishan Singla, erstwhile trader doing business in shop number 25 of Anaj Mandi, Sirsa, has been found to be the kingpin in several firms. “He opened firms at Rohtak, Kanina, Bhuna and Gurugram by paying Rs 7,000 per month to people like Naveen and Praveen, both brothers, and Charan Singh, who would help open firms in names of unsuspecting women,” Kaushal explained. He said the department is taking up the case for reference to the DGP, Crime Branch, for inter-district inquiries.

Kaushal said a departmental inquiry has been ordered to detect any collusion of officers. “In Haryana, we have 4.4 lakh units registered under GST. At the time of VAT, 2.5 lakh units were registered. Officers are repeatedly instructed to verify newly registered units,” he added.

Meanwhile, Haryana has decided to strengthen the enforcement in GST and Excise. Kaushal said the CM has sanctioned 350 cops for the enforcement division.