Sushma Ramachandran

Senior Financial Journalist

THE question being posed lately is whether the slump in the Indian economy can be blamed on external factors or not. Former Reserve Bank of India (RBI) Governor Raghuram Rajan, in a recent lecture, said the fault

for the current slowdown cannot be pinned on the rest of the world. On the other hand, visiting World Bank chief David Malpass says the lagging pace of growth is linked to the global slowdown. Plus, several developments, like trade tensions, the delay in implementing Brexit, and low global investment rate are affecting many countries.

The fact is, one cannot completely exclude the effect of external developments on any economy. And currently, there are a host of global issues that have contributed to the slowdown along with other domestic factors. The worldwide dip in growth from 3.6 to 3 per cent in 2019 has definitely had a ripple impact on this country as on many others. One of the reasons for the sluggishness cited by the International Monetary Fund in its World Economic Outlook is the rift between the US and China over tariffs which has spiralled into trade wars by the world’s largest economy with many of its trading partners. The repercussions on India have been due to the withdrawal of concessional tariffs on exports to the US which is bound to affect many commodities. There remains hope, however, of a negotiated settlement on the issue shortly. The delay in implementing Brexit may not have had the same impact but it has created uncertainty among the many large corporates that have dealings with both the UK and Europe. Besides, there is undoubtedly a contagion factor as far as the global low investment rate is concerned with geopolitical tensions being a major cause for investors to remain subdued in recent times.

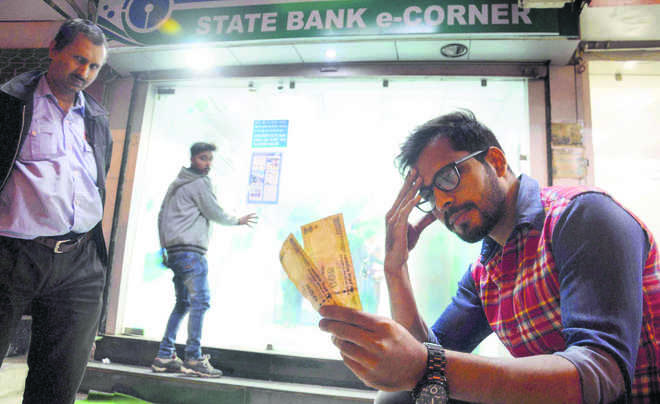

Rajan, however, has a point in that most of the issues related to slowing growth have occurred owing to policy shortcomings over the past decade. The failure of the UPA to accelerate the reforms process begun by the Narasimha Rao government in the 1990s and carried forward by the Vajpayee regime, laid the ground for the present situation. It is ironical that Congress leaders repeatedly hark back to the need to go back to the policies of Dr Manmohan Singh, when in fact, economic reforms actually stalled during UPA regime in its two tenures. As far as the Modi 1.0 is concerned, it has to be said that brave efforts were made to implement a series of big reforms, though these were not all well thought out. The big failure, of course, was demonetisation. It was a disaster in implementation, as both Rajan and C. Rangarajan have rightly pointed out, because the new currency was not in place before phasing out the old one. Apart from the impact on industry, it had an enormously adverse effect on the poorest of the poor who relied for sustenance on the cash economy.

But other reforms were carried out effectively, including the Insolvency and Bankruptcy Code (IBC) and the Real Estate Regulation and Development Act (RERA), along with recognising that the banking sector was in deep trouble with NPAs. The central bank also carried out the asset quality review of banks during Rajan’s tenure which brought the enormity of the problem into limelight. The IBC was seen as the right move to resolve the issue, but sadly, the process has got bogged down due to court interventions sought by the involved parties. The real estate legislation was equally well thought out and aimed at ensuring that consumers’ interests were kept paramount rather than allowing the builders’ lobby to hold sway. Problems arose here too as the central law has to be ratified by each state. In this process, some states have been trying to make amendments that could dilute key provisions of this consumer-friendly legislation. Steps are reported to be under way to make changes in the central law both to clarify it and ensure that it remains essentially pro-consumer.

The mega reform of the Goods and Services Tax (GST), in contrast, has had problems right from outset. Though hailed a potential game-changer for the economy, it became a disruptive force at all levels of industry. More so for small and medium businesses that found it difficult to adapt to the new digitised system. In addition, the multiplicity of tax rates defeated the entire purpose of the original GST concept which is to have a simple single tax rate across all commodities. States are as responsible as the Centre for the complexity as rates were decided by consensus in the GST council. The timing of the rollout, however, was decided by the government and clearly it was not fully prepared for the impact on industry.

In the second term, however, the Modi government needs to forge ahead with reforms in key areas, especially as the economy is moving in slow motion. The World Bank chief has identified some sectors that need a focus, including land management which has proved to be one of the biggest pitfalls for setting up a business in this country. Financial sector reforms are also needed with greater regulatory provisions for NBFCs which are currently facing a crisis and have had a cascading effect on the entire gamut of financial institutions. In addition, Malpass identified stronger courts and enforcement of contracts, a key area of concern for investors. The judiciary clearly needs to ensure that its interventions do not slow down the pace of development, especially in areas like bankruptcy where recourse to courts has hit progress in dealing with the NPA issue.

It is evident that the world’s eyes are now on India’s growth and its potential to be one of the fastest growing economies in the world. Unless the government tailors its policies to provide a comfort level to foreign investors, the flow of investment from abroad will not rise as much as needed to spur growth to at least 8 or 9 per cent. It’s high time for Modi 2.0 to quickly show its resolve to push growth and investment to reach these desired levels.

Unlock Exclusive Insights with The Tribune Premium

Take your experience further with Premium access.

Thought-provoking Opinions, Expert Analysis, In-depth Insights and other Member Only Benefits

Already a Member? Sign In Now