New Delhi, December 10

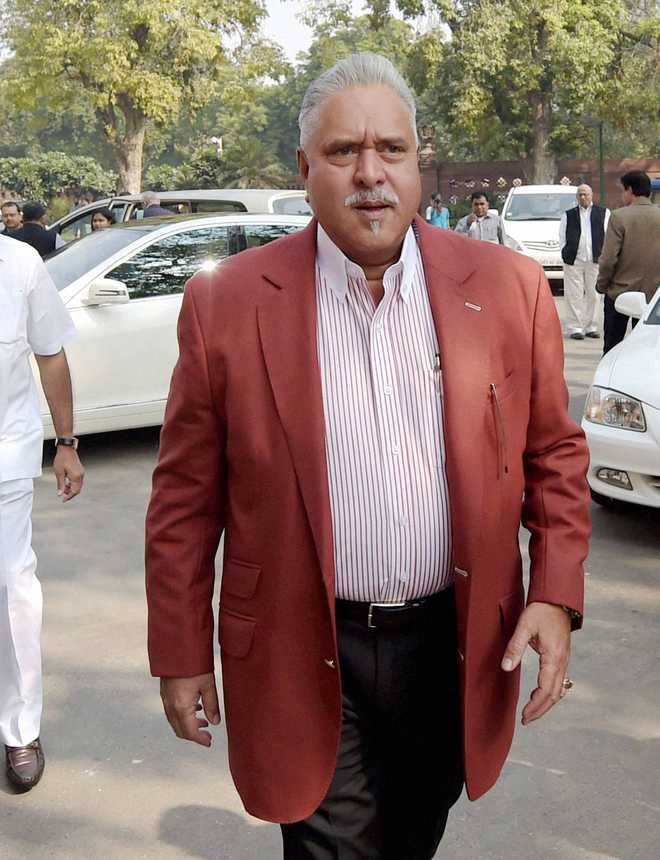

The CBI today examined UB Group Chairman Vijay Mallya in connection with its probe into alleged loan default of Rs 900 crore taken from IDBI bank.

The sources said Mallya was called to agency Headquarters here in connection with the case where the team of Banking Securities Fraud Cell carried out his detailed questioning.

The company said it will not comment on the matter.

CBI has registered a case against Mallya, Director of defunct Kingfisher Airlines; the company; A Raghunathan, Chief Financial Officer of the Airlines; and unknown officials of IDBI Bank.

It is alleged that the loan was sanctioned in violation of norms regarding credit limits.

The CBI sources said an FIR into the alleged violations was registered recently as part of its wide probe into criminal aspects of loans declared to be non-performing assets by public sector banks.

The sources said there was no need for the bank to take the exposure outside the consortium.

"It was first exposure to the bank. There was no need for the bank to take the exposure outside the consortium when already other loans were getting stressed," a senior CBI official, probing the matter, had earlier said.

The bank will have to explain reasons for extending the loan to the airlines, ignoring its own internal report which has warned against such a move.

The debt-laden airlines stopped operations in October 2012.

The CBI sources said the agency has registered a total of 27 inquiries and cases with regards to "bad loans" given by public sector banks to various corporates in 2013. — PTI

Unlock Exclusive Insights with The Tribune Premium

Take your experience further with Premium access.

Thought-provoking Opinions, Expert Analysis, In-depth Insights and other Member Only Benefits

Already a Member? Sign In Now