Sushma Ramachandran

AS the country reels over the shock of multiple bank frauds and the potential impact of lakhs of crores of bad loans in the banking system, there is a growing clamour to find out the reasons for this situation. One of the answers being given is that bank operations are overly controlled by the government, leading to the influence of powerful political lobbies. The only solution, it is being argued, is to privatise banks immediately and allow them to run their own affairs to avoid the taint of crony capitalism. It does seem tempting to accept this solution. The facts support most of this thesis. Public sector banks are indeed vulnerable to pulls and pressures from the government. And this has surely created many infirmities in the banking system. But these fractures in the structures of public sector banks need to be repaired rather than resorting to privatisation, a move seen as the panacea to all ills. On the contrary, this will not magically solve these problems as all is certainly not well with private banks either in this country or in others.

One must go back to the past and recall that Indira Gandhi nationalised banks in 1969 at a time when the track record of private banks was rather poor. Many private sector banks were collapsing and depositors' money simply vanished in thin air. The nationalisation may have had a political motivation and an eye on the elections, as is constantly argued by the former Prime Minister’s detractors, but the results were a boon to the general public. Financial inclusion rose rapidly from then onwards, with the sudden increase in branches of these newly nationalised banks. The number of bank branches rose from 8,000 in 1969 to 32,000 in 1980 and 60,000 in 1990. Rural branches spiked from only 1,800 in 1969 to 34,000 in 1990. Besides, it had become possible for a person to open an account with a small amount of money. Former chief economic advisor Kaushik Basu even credits bank nationalisation with ending the stagnation in economic growth by raising the savings and investment rate.

Hence, bank nationalisation was not just a misguided political initiative tagged on to the Garibi Hatao campaign that won the 1971 elections for Indira Gandhi. It was an economic reform that benefited the country in a substantive manner.

It was much later, in 2008, when the whole world was facing a financial crisis with iconic financial institutions in the developed world having collapsed, that high praise was lavished on the nationalised bank systems in this country. Former RBI governor YV Reddy in an interview had then pointed out that even the best Indian private banks were affected by the global financial crisis but public sector banks came out unscathed.

One must state the obvious at this point, which is that all the international financial institutions which failed at the time were in the private sector. This includes the iconic Lehman Brothers and Bear Stearns which collapsed while others like Merrill Lynch, AIG, and the mortgage lending institutions, Fannie Mae and Freddie Mac had to be rescued by the state. The latter two were originally set up by the US government but then legislated into private entities. Apart from the 2008 financial crisis, there have been many instances of bank frauds leading to closures such as Barings Bank which had to down shutters due to the activity of a single rogue trader. Officials of Barclays Bank of the UK are reported to be only now facing fraud charges over activities carried out in 2008. Hence, there is no such thing as an idyllic world of private sector banking where frauds do not exist and crony capitalism does not play a role.

Even private banks in this country are not immune to the same problems that plague the public sector entities. The huge NPAs (non performing assets) stressing the banking industry are not just carried by state-owned banks. Private banks, too, have their share of bad loans. The recent half-year financial stability report by the RBI noted that the rate of increase for NPAs was 40.8 per cent for private sector banks as against 17 per cent for public sector banks on a year-on-year basis in September 2017. It also disclosed that all top private sector lenders, including ICICI Bank, Axis Bank, Yes Bank and HDFC Bank, had under-reported their dud assets in the first two quarters of the fiscal. In other words, the private banks renowned for their speed and efficiency in contrast to the tortoise-like pace of the state-owned banks are in the grip of the same malaise of mounting bad loans as the latter.

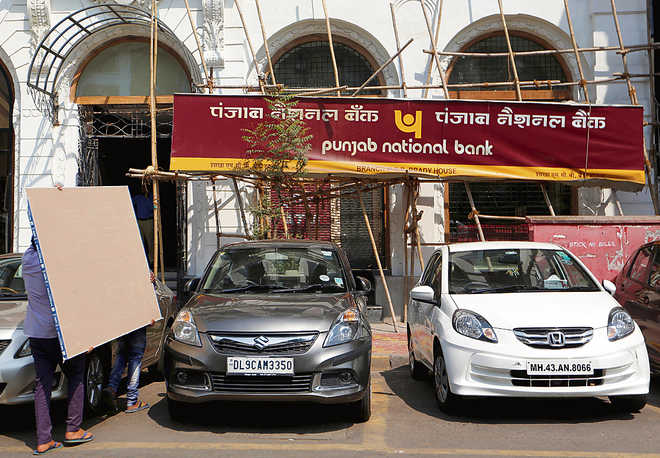

Privatisation, then, is not the over-arching solution to all the woes facing the government-owned bank industry. It is undoubtedly true that a major restructuring is needed in the operations and performance levels of these banks. Regulatory agencies, including the central bank, need to become more vigilant and the role of auditors needs to be probed further. Banks are already being audited multiple times and, hence, the need for a regulatory agency to make sure that auditors are playing their due role. As the Nirav Modi-Punjab National Bank scam unfolds, it is clear that those who were to monitor transactions failed at their job. It must be recalled that one of the fallouts of the scandal surrounding the US energy company Enron was the closure of reputed accounting firm, Arthur Andersen. Here too stern action must be taken against auditing agencies.

At the same time, greater autonomy needs to be given to state-run banks. The issue of bank chief appointments, for instance, is a key issue meant to be handled by the relatively new Banks Board Bureau. Instead, it seems to remain the purview of the Finance Ministry. All these issues will now have to be reviewed and overhauled in the light of the worsening news from banks.

The government needs to take up the issue of reviving the banking sector in all seriousness. Privatisation is surely not the way forward. But steps to improve governance standards need to be taken immediately to cleanse and revive this crucial sector of the economy.

Unlock Exclusive Insights with The Tribune Premium

Take your experience further with Premium access.

Thought-provoking Opinions, Expert Analysis, In-depth Insights and other Member Only Benefits

Already a Member? Sign In Now