Neeraj Bagga

The real estate of the Holy City, once compared with Tier I cities like Gurgaon and Noida, has been stagnating since 2012 when the SAD-BJP government came to power in the state for the second time.

One main indicator of a slow market is the reluctance on the part of investors to enter it, and over the past three years the number of investors on Amritsar realty scene has been absymally low. According to market watchers the government policies have been the major deterrents for the investors here.

Great expectations

This is in complete contrast to the scenario before 2008 when there was boom in the real estate sector in Amritsar. Riding on the boom wave, Amritsar realty had scaled the graph swiftly following the announcements of setting up a special economic zone for export purposes, increasing global connectivity to the city with the rise in number of international flights at Rajasansi International Airport and indications of opening of the Wagah-Attari joint check-post for trade with Pakistan.

There had been catalysts enough to drive the real estate czars of the sector to move to this border town with mega projects offering state-of-the-art civic amenities with residential plots, flats along with foolproof security and other amenities.

Over 40 colonies, including 10 mega townships spread over 100 acres each, were set up primarily on the periphery of the city and beyond it by well-known national developers like Ansal Buildwell, AIPL Ambuja, Impact Gardens and Nirvana Metcalfe, among others. The minimum rate in the non-planned localities, which have come up on the outskirts of the city, is upward of Rs10,000 per sq yd. On the other hand in the planned localities it is much higher. Besides, plot sizes in these localities above 100 sq yd. It makes minimum cost of a house complete with construction above Rs20 lakh.

These well planned projects attracted several buyers from the old city areas who invested here in order to get the taste of better lifestyle from the congested lanes in the old city areas. As Atul Seth, a resident of Akash Avenue, says he found a good opportunity in moving out to his present location and sold off his ancestral house in 2008 for Rs5 lakh.

But oflate the value of real estate sector of over four century old walled city, spread around the Golden Temple has recorded a rise.

Old charm

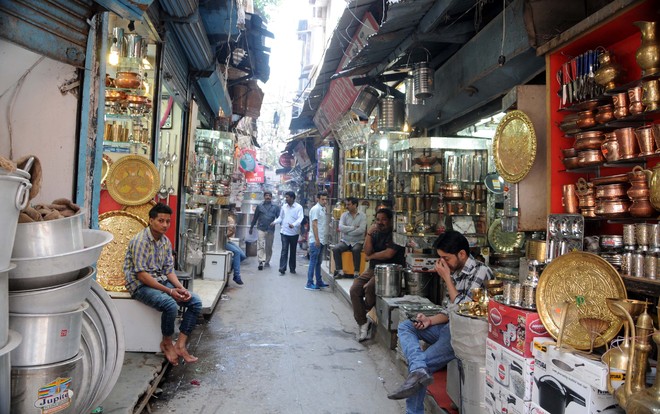

The walled city has been known for its labyrinthine road network dotted with old structures. Architecturally its housing is defined as shared-wall housing where a high proportionate of the houses are between 40 sq yd and 75 sq yd. There is no demarcation of separate commercial and residential areas and shops and homes merge into each other here. Hardly any road here is 20-feet wide making parking of vehicles a huge headache for those living here.

With the number of families owning four-wheelers increasing in these lanes, the trend of rented parking space has become popular here. However, the rates of parking cars are very high. Several individuals having open spaces have simply demolished old structures and transformed the open space into car parks. Monthly rent of parking car is decided on the basis of the size of a car. It could vary from Rs1500 to Rs2500 per month. Though there is a complete sewerage and water connectivity in the old city, garbage disposal and lifting is undoubtedly a regular trouble as narrow roads offer limited space to manouver.

Demand drivers

But in spite of these factors there has been a spurt in demand for properties in several areas in the walled city.

According to local property dealers the arrival of skilled gold artisans from Maharashtra and West Bengal has jacked up the cost and demand of housing in the walled city areas.

This rise in prices of real estate is unique in the sense that the narrowest and winding streets that were the least favoured during the boom that gripped the rest of the town over a decade back, have found many takers now.

This is evident in the streets around the historic Guru Bazaar area — the hub of gold business. A jeweller Krishan Kakkar said since a majority of Punjabi artisans had shifted to trading, they had brought skilled artisans from West Bengal and Maharashtra. “Even though though these artisans have been working here for the past over 10 years, now they are looking to buy properties to avoid paying rent”. So, there has been an increase in demand, while there is paucity of space here. This has resulted in a jump in property prices in these areas.

A property dealer and builder Rajesh Kumar said, “There is not an inch of open land available in this area. Besides, it is the densely populated area. Hence, the rule of value of a square yard of land is not practically followed here and owners demand price of a whole unit as per their will. While the buyers also pay the price as per their need.

He added that the phenomenon of high demand of houses was visible in localities situated around Guru Bazaar. These areas are Zamandar Di Haveli, Khoo Sunarian, Gali Tiwariyan Gali Lamba Wali, Katra Charat Singh and scores of narrow roads in these areas.

Rates of commercial properties were invariably high as shops are normally passed on from a generation to another in the family. This has led to setting up of four-storey buildings in which shops are at ground floor and the rest of the portions are serving as workshops for artisans.

Shops are coming up even in the narrow streets close to Guru Bazaar. Rajesh said there was no fixed rule and markets define these transactions. Major factor is location and construction of the shop.

Two-room houses are available on rent from Rs2000 to Rs6000 per month. For residential housing there is no need to pay advance but in the commercial sector one has to pay “Pagri” — an amount paid in advance which is non-refundable and in addition to the monthly rent.

It was investors who drove up the prices in the colonies on the outskirts, but in the parts of old city it is financiers and real buyers who are looking for space.

Unlock Exclusive Insights with The Tribune Premium

Take your experience further with Premium access.

Thought-provoking Opinions, Expert Analysis, In-depth Insights and other Member Only Benefits

Already a Member? Sign In Now