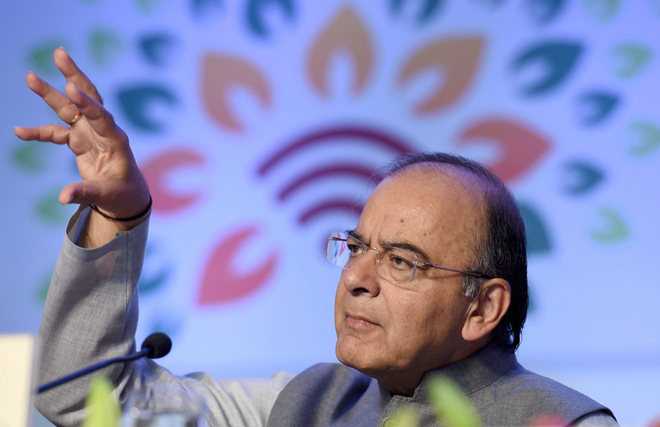

Finance Minister Arun Jaitley speaks at XXIII Commonwealth Auditors General Conference in New Delhi on Wednesday. PTI

Tribune News Service

New Delhi, March 22

Finance Minister Arun Jaitley today said the Goods and Services Tax (GST) will reduce the prices of items by avoiding tax on tax and will help in curbing tax evasion.

Listing the advantages of GST, which is likely to be rolled out from July 1, Jaitley said it will bring transparency and efficiency in tax administration, reduce the prices of various items by avoiding tax on tax and ensuring seamless transfer of goods from one region to another, among others.

Speaking at the 23rd Conference of the Commonwealth Auditors General, Jaitley said India has “hugely” a non-tax compliant society and the government banned higher denomination notes to curb the tendency of people to deal in cash that lead to tax evasion and terror financing.

The Finance Minister also said the major indirect tax reform in the history of the country since independence, GST is likely to be rolled out from July 1 this year which will simplify the most complicated indirect tax system in the country by subsuming various Central and State indirect taxes.

“The laws which enable Goods and Services Tax are now before Parliament, which hopefully should get cleared and once they do get cleared, then by the middle of this year we hope to see the implementation as far as this law is concerned,” the Finance Minister said.

In terms of tax compliances, he said India ranks fairly high as a non-compliant state.

“Therefore, one of the efforts of the state has been how to bring non-compliance to an end. Once the Goods and Services Tax is introduced, it will be a great check as far as evasion is concerned,” he said, adding that the government has amended direct taxation law by bringing in curbs on cash currency.

The Finance Minister also touched upon the issue of demonetisation stating that by withdrawing the legal tender character of Rs 500 and Rs 1,000 notes, anonymity attached with the cash is over and informal sector has to a large extent integrated with the formal sector, thereby making the Indian economy cleaner, transparent and efficient.

He said cash was incentivising crime, corruption, tax evasion and black money among others.

The Finance Minister said demonetising on the one hand helped in tackling all these problems while on the other hand, it led to increased digitisation of transactions and reducing the overall impact of shadow economy among others.