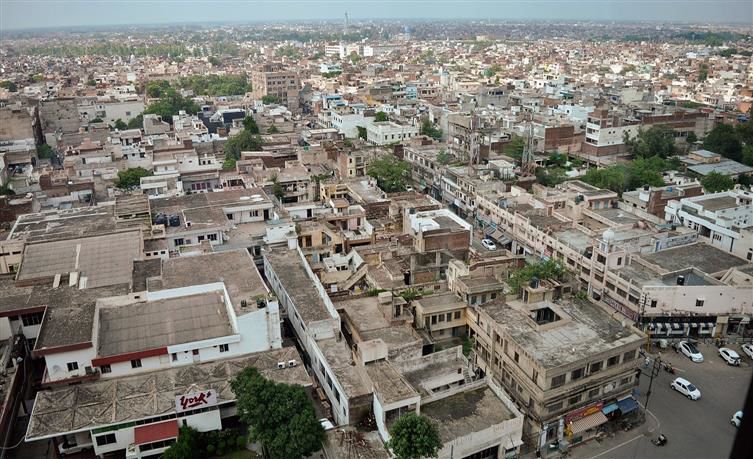

Despite exceeding its target for property tax collection for the previous fiscal year, the MC is yet to recover Rs 6.12 crore in arrears from around 25,000 defaulters. - File Photos

Wilful defiance should be penalised

The extent to which defaulting has become commonplace, especially when it comes to paying the property tax, is a cause of grave concern as it has the potential to escalate into a serious trend. In recent years, the MC has been afflicted by the troubling act of defiance in the form of non-payment of property tax. Though the number of defaulters may not be much, arrears amounting to Rs 6.12 crore are significant because that amount could have been used for many development projects in the city. It is deeply troubling that such flagrant acts of defiance are taking place under the watchful eye of a government body that claims to have collected a record Rs 708 crore in property taxes last fiscal year by strictly adhering to the rules. However, contrary to the claims, there are numerous examples of rules being flagrantly violated by people who have failed to pay their property tax or water bills for years. To make matters worse, some of them have openly encroached on government land leading the 20-foot road in front of their houses to become a bottleneck. People must understand that property taxes are paid to municipal authorities in exchange for access to civic amenities and quality infrastructure. Therefore, if someone wilfully fails to pay for the services availed, that person should face severe penalties.

Novin Christopher

Attach properties of defaulters

Attach properties of defaulters

Property tax is an annual charge levied by a local government or the MC of an area and is paid by the owners of properties within its jurisdiction. Property here means all types of tangible real estate properties, houses, offices and commercial buildings. The collected tax is used to provide basic amenities like water and sanitation, environmental protection, proper access to public transport, etc. Though the Ludhiana MC achieved its target for property tax collection for the financial year 2023-24, yet over 25,000 defaulters failed to deposit their property tax for the past year despite receiving multiple notices from the MC. These defaulters are now subject to more penalties and interest on their pending amounts. With an aim to generate maximum income from property tax, the Ludhiana Municipal Corporation should once again start a drive to recover the arrear amounts from both private and public owners of property. The process should also be initiated to recover the pending rent amounts of properties that were leased out or given on rent by the civic body. It should be pressed upon the owners of these properties that if they fail to deposit the overdue amount, the consequences can be serious. Official notices for recovery should be served to the defaulters and if they still don’t come forward, their properties should be attached so that they may not be able to sell or transfer their properties unless they pay the outstanding amount of tax, penalty and applicable interest. A one-time-settlement scheme (OTS) for clearing the property tax dues for the chronic defaulters may be announced wherein some rebates like waiver of penalties and penal interest can be provided for to attract the property owners to clear their dues.

RS Sembhi

Revenue to boost development

The record revenue collections under property tax and other heads in 2023-24 were made possible only due to the voluntary deposits by the residents, other tax-payers and hard work by the civic officials concerned to ensure maximum recoveries. The increased revenue collections will certainly help fund more development projects in the city as a major chunk would be spent on further improving the basic civic amenities being provided to the residents. Those, who have not yet cleared their dues, are once again issued notices, failing which stern penal action will be initiated against them. — Sandeep Rishi, MC Commissioner

Utilise advertising to call out defaulters

Taxes are the lifeblood of civic services ensuring the smooth functioning of essential amenities for all residents. Over 25,000 defaulters withholding funds inadvertently means the civic body lacks resources for vital improvements. This issue requires a rock-solid and determined approach to bring about a meaningful change. The government must initiate a dedicated two-year project wherein bold advertising campaign across city news channel and newspapers should be utilised in order to let the residents know about the gravity of the situation. An advertisement alone could spur some defaulters to pay their overdue taxes. However, it must be noted that some large companies who otherwise are compliant but have significant property tax burden could be eligible for tax subsidies or discounts. For those struggling to pay, a grace period and assistance programme should be available. However, failure to meet deadlines should not result in government’s oversight and penalties should be employed. By enforcing strict measures for two years, related to this issue, the civic body can realise its objectives to enhance our lives significantly. The local government is often criticised for its perceived inadequacies, yet individuals must acknowledge their own role in decision making. True progress demands accountability from all parties involved.

Harshita Vasan

MC should avail services of police

Many public and private bodies have not yet paid the property tax to the Ludhiana Municipal Corporation (MC). The result is that the progress on projects undertaken by the MC is suffering and consequently the public is not benefiting. It is a sad state of affairs. The defaulters must pay their dues to the corporation regularly and in time. However, I reckon there should be no difficulty in collecting the overdue amount from public sector bodies. The corporation must persist in its efforts to recover the outstanding amount by serving notices and visiting the premises of the defaulters. The collection of dues from the public is a cumbersome process and we as responsible residents of Ludhiana must assist the MC staff wherever possible. The MC should also avail the services of the police to reach out to these defaulters and express a stern approach when it comes to the recovery of the overdue amounts. If the MC officers and staff use these avenues the corporation will get the funds which it in turn will use for the advantage of the residents.

Gautam Dev

Simplify filing of tax, conduct audits

Improving tax compliance and collecting dues is critical for any government. By simplifying the tax filing process, the government can ensure compliance. They should invest in easy-to-use web platforms, offer clear instructions and simplified forms. Reducing paperwork and regulatory obstacles can help taxpayers comply more easily. Additionally, establishing local centres where taxpayers can seek assistance, clarify questions and obtain directions will help increase compliance. These institutes can also help with conflict settlement. Furthermore, the local government should conduct periodic audits to ensure compliance. Random checks can keep taxpayers on their toes, discouraging evasion.

Tamanpreet Kaur Khangura

Cut civic amenities of defaulters

To collect property tax efficiently the city must be divided into different zones. Under each zone, it must be divided into wards. And each such ward must be under the purview of a municipal councillor’s duties. The councillor would need to depute some officials to collect property tax. The delegated workers need to visit each household to collect the property tax. If the municipal corporation keeps the record of each household then the defaulters too must be in their notice. The corporation must issue regular notices to them and if the situation gets worse connections to the civic amenities such as sewerage and electricity must be withdrawn. There must be a proper check on the defaulters and colonisers. The civic body must cancel the licence of those colonisers who are not depositing their property tax. List of defaulters must be published in newspapers.

Dr Mohd Saleem Farooqui

Attach defaulters’ bank accounts

It is a very sorry state of affairs that some residents of Ludhiana and particularly colonisers are not depositing their property tax. A team along with police officers must visit them and their bank accounts must be attached with the corporation main accounts so that the tax can be automatically debited. The defaulters must be given some time to pay the tax, but after that they should be strictly penalised. Officials from the municipal corporation must visit these defaulters and collect the outstanding property tax at their doorsteps. Residents must cooperate with the local government and pay the property tax in time.

Farzana Khan

Publicise consequences of non-payment of tax

To recover the dues and curb rising defaults, the municipal corporation should implement a multi-pronged strategy. This includes stricter enforcement measures such as imposing penalties, initiating legal action and publicising the consequences of non-payment. Introducing convenient payment options and offering incentives for timely payments can also encourage compliance. Additionally, enhancing communication channels to educate property owners about their tax obligations and consequences of defaulting is crucial. Moreover, conducting regular audits to identify and address systemic issues contributing to defaults can help improve tax collection efficiency.

Lakesh Negi

Utilise tech to facilitate easier collection of tax

To recover the dues and curb rising defaults in property tax payments in Ludhiana, the municipal body needs to implement stricter penalties for late payers. The civic body should incentivise early payments and utilise technology to facilitate easier payment methods. There is a need to increase public awareness about tax-related duties through campaigns. Enhanced penalties and enforcement are very much needed against persistent defaulters. However, for the lay resident there should be a provision of assistance programmes to help the proprietors pay their dues without much hassle. The MC needs to establish communication channels and follow-up with the defaulters. These actions can help expedite debt recovery and foster a culture of compliance with tax obligations.

Jasleen

QUESTION

A patient’s corpse was kept lying on the same bed where another alive patient was lying at the emergency ward of the civil hospital here recently. What should be done to check such negligence and insensitivity in the public health centres and fix the accountability of the doctors and officials concerned?

Suggestions in not more than 200 words can be sent to [email protected] by Thursday (April 25)

Join Whatsapp Channel of The Tribune for latest updates.