Shaktikanta Das, RBI Chief

Sandeep Dikshit

New Delhi, August 5

The Reserve Bank of India (RBI) on Friday announced an increase in interest rate by 50 basis points, the third straight increase since May, in a move that will affect home loans as well as fixed deposits. The aim is to check inflation, but care is being taken to ensure adequate liquidity for the industry and to not unduly burden the common man, said RBI chief Shaktikanta Das.

Unacceptably high

Inflation still remains at unacceptably high levels and, therefore, monetary policy has to act. Shaktikanta Das, RBI chief

NRIs can use Bharat Bill Payment System

- The Indian diaspora will soon be able to pay utility bills and other recurring payments like fee using the Bharat Bill Payment System, the RBI announced

PNG to cost Rs 2.63/unit more in Delhi, NCR

- The price of piped cooking gas (PNG) in the national capital and adjoining cities has been hiked by Rs 2.63 per unit, the second increase in less than two weeks.

- It will now cost Rs 50.59 per standard cubic metre in Delhi, as against Rs 47.96 previously. PTI

Das’ 6-point economy scenario

- Indian economy resilient despite two black swan events and multiple shocks

- Signs that inflation will moderate after December but remains uncomfortably high. There are also several uncertainties. That is why the 50 basis point hike was unanimous

- Steps have to be taken consistently to contain inflation

- Excess liquidity being gradually brought down

- RBI has the ability to finance Current Account Deficit and deal with excess volatility of exchange rate.

- Monetary policy will be calibrated, measured and nimble depending on the unfolding dynamics of inflation and economy

“Fifty basis points is the new normal. Some central banks have increased by 75 to 100 basis points, but at the RBI, we have taken care not to unduly hurt growth prospects, including home loan and prospective real estate,” he said at a press conference. The most likely scenario of the impact of the RBI’s Monetary Policy Committee decision to raise the repo rate – at which it lends to banks — will be a pass-on effect on fixed deposit rates as well as costlier home loans. “Quite a number of banks have raised fixed deposit rates and that trend will continue. When there is credit off-take (by the industry and retail consumers), banks cannot rely on the central bank perennially. They have to raise their own resources and funds,” he said.

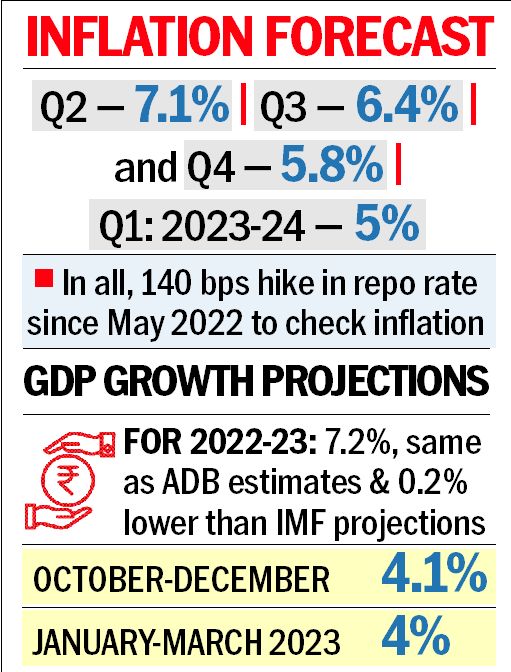

The RBI’s main focus — consumer price inflation — has eased from its peak in April but remains “uncomfortably high and above the upper threshold of the target”, but Das felt that it would slide to a more bearable 5.0 per cent by March 2023. Inflation is projected at 6.7 per cent in the current fiscal, with quarter two (July to Sept) at 7.1 per cent; quarter three (Oct to Dec) at 6.4 per cent; and quarter four (Jan to March) at 5.8 per cent.

The RBI sounded a note of caution about the farm sector in view of kharif sowing being marginally below last year’s level due to uneven rainfall distribution. A good progress of the southwest monsoon and kharif sowing would support rural consumption but the shortfall in sowing of paddy, however, needs to be watched closely, although buffer stocks are quite large, it said.

On the rupee, the RBI felt it had fared much better than several reserve currencies as well as its Asian peers. Its depreciation is more on account of the appreciation of the US dollar rather than weakness in macroeconomic fundamentals. The RBI has also used its foreign exchange reserves to curb volatility in the exchange rate but despite the resultant drawdown, their level remains the fourth largest globally, said Das.

Simultaneous impact of EMEs are facing a rapid tightening of external financial conditions, capital outflows, currency depreciations and reserve losses simultaneously.

Join Whatsapp Channel of The Tribune for latest updates.