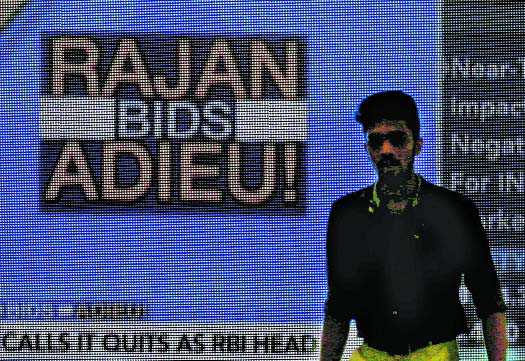

A man walks past a screen displaying news of markets update inside the Bombay Stock Exchange building in Mumbai on Monday. REUTERS

Tribune News Service

New Delhi, June 20

Allaying fears of a selloff on the exit of RBI Governor Raghuram Rajan, stock markets ended in the green today by 241 points as the government announced new FDI reforms and Brexit fears eased.

Markets also got a boost after global rating agency Fitch allayed concerns of any impact on India's sovereign ratings due to RBI Governor Raghuram Rajan's decision against a second term saying "policies are more important than personalities" on this front.

The BSE Sensex lost 178 points in early trade to hit a low of 26,447 points on Rajan's announcement. However, hectic buying thereafter helped the index return to the positive zone within minutes as it settled 241 points higher at 26,866 points.

However, analysts said that Rajan’s exit will cause some uncertainty. Dhananjay Sinha, Head- Institutional Research, Economist & Strategist, Emkay Global Financial Services, said, “We believe that Rajan’s exit will not be inconsequential. We face an impending context of rising inflation and redemption of FCNRB deposit, which requires a deft handling of financial market. Also any retraction from the ongoing cleansing process of banking sector balance sheets and corporate consolidation could prolong the structural adjustment required for enduring growth recovery. Clearly, uncertainty on the three things is going to intensify”.

He said it will require a very credible face to keep the market sentiment clam. “It will be germane for the government to instill confidence on the continuity of the banking stability process”, he added.

Dipen Shah, Senior VP & Head Private Client Group Research, Kotak Securities, said markets ended the day higher, despite the negative surprise of the RBI Governor leaving office after completing his term in September.

“Markets were bolstered by the expectations of a positive outcome from the Brexit poll. FDI relaxations by the government in several sectors buoyed sentiments that, reforms were continuing. Advance of monsoons has also helped the markets”, he added.

Ajay Bodke, CEO & Chief Portfolio Manager – PMS, Prabhudas Lilladher said that the sudden exit of Rajan would lead to an initial wobble in the currency, bond and equity markets however India’s strong macro-economic fundamentals would ensure that India remains one of the most favored investment destinations for foreign investors.

Anand James, Chief Market Strategist, Geojit BNP Paribas Financial Services said, “Though uneasiness shrouding Dr Rajan’s exit forced a downside gapped opening, the lower prices were gobbled up by the positivity seen across Asian markets, as Brexit fears eased. It also helped that government eased FDI norms in aviation, defence and pharma sectors, adding to similarly oriented measures of last week, embellishing hopes that the reform led rally is gaining traction."