Ananya Panda

Tribune News Service

New Delhi, December 12

The Delhi Government’s Trade and Tax Department, in a preliminary examination, has found that around 8,700 dealers registered with it have been showing fraudulent tax deposits into 13 banks since 2013 causing a loss of Rs 262 crore to the exchequer.

This means the tax payments that were claimed to have been made by the dealers was actually evaded by them, after hacking the internet systems of the department and banks.

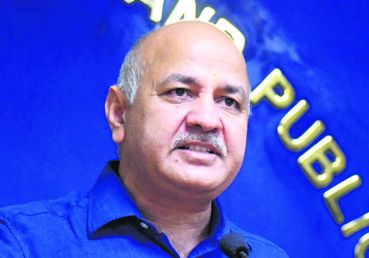

The matter has been handed over to the economic and offences wing (EOW) of the Delhi Police for registration of an FIR, Deputy Chief Minister Manish Sisodia told reporters here.

The action came following an investigation by the department conducted during the last three months over a tip-off.

“A serious cyber tax fraud was going on since 2013. In this around 8,700 traders had created fictitious IDs in the VAT system and the bank platforms. They had cracked IDs and passwords of banks and the government. They had hacked details of at least 13 banks as revealed by inquiry as of date,” said Sisodia, who also holds the finance portfolio in the city government.

Noting that traders of Delhi deposit their tax in around 27 banks in the capital, Sisodia stated, “We got on indication of this fraud about three months ago. We put our entire system on high alert.”

The system branch of the Trade and Taxes Department, noticed during the verification of payments under the erstwhile Delhi Value Added Tax (DVAT) Act, 2005 read with Central Sales Tax Act (CST) Act, 1956 that some of the payments shown made by dealers via banking channels were actually not received by the government.

A scrutiny of the available records by the branch prompted it to contact the respective banks to verify the veracity of few credits of payments shown in the VAT and CST returns of some dealers.

“In response to our letters, these banks confirmed that the said payments have not been credited to the Government exchequer,” said Commissioner (VAT/GST) H. Rajesh Prasad today in an inquiry report.

“This kind of cheating and fraud has been continuing since September 30, 2013 and from then to September 26, 2018 a total of 8,758 dealers have been identified who have made 31,027 transactions amounting to Rs 262,62,73,327. A complaint in this regard has been sent with all available details to DCP, EOW, of the Delhi Police for registering an FIR and conducting a thorough investigation in the matter,” Rajesh stated.